|

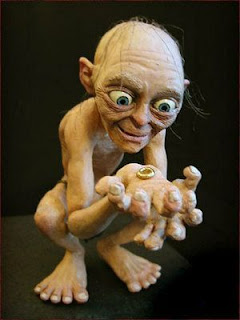

| Get a grip on food security. Don't let anyone grab it! |

Retired USDA economist Fred Gale peers through the "dim sums" of puzzling data that don't add up to provide insight about China's agricultural markets in bite-size pieces like Chinese "dim sum" snacks.

Gollum-esque Food Bowl Grip

China's corn production boom resumes

China produced another record grain harvest, according to a communique on 2021 grain production released by the National Bureau of Statistics. Output was 682.9 million metric tons (MMT), up 13.4 MMT or 2 percent from last year.

|

| Compiled from China National Bureau of Statistics data. |

A Bureau official attributed the rise in grain production to strict control of cultivated land by each level of government carrying out their responsibility for grain production. Local leaders prevented farmland from being left idle, demanded that crops be planted on idle land, ensured cropland was not diverted to nongrain crops, reclaimed land for agricultural use, and increased farmers' enthusiasm for planting grain crops, the Bureau official explained. The report said 117.6 million hectares of land was planted in grain, up 0.7% from the previous year.

Corn production resumed to its historic steep path of growth after a 5-year interruption. Corn accounted for most of the increase in this year's grain production. Soybeans were the only major crop to post a decline in production.

Just six years ago China was suffering from a glut of corn. The agriculture ministry's "supply side structural adjustment" initiative called for cutting back on corn production and rotating corn with beans, minor grains, fodder crops, and other less environmentally damaging crops. Corn was to be cut back in an environmentally fragile "sickle-shaped region" stretching from northeast provinces through semi-pastoral areas, arid northwestern provinces, and the mountainous southwest. The plan called for cutting back corn area from 38.1 million hectares in 2015 to 34.7 mil. hectares in 2020.

That plan was conveniently forgotten after several years of corn auctions emptied out warehouses and corn prices shot up in 2020.

The 2020 target was also forgotten because calling attention to it would necessitate explaining a big statistical blip in corn data. The Statistics Bureau's 2017 agricultural census discovered an additional 6.85 million hectares of land planted in corn, and corn statistics were revised upward by 20%. The statisticians decided they had been undercounting corn production for a decade and revised their numbers retrospectively back to the previous census in 2007. The current data published by the Bureau show that area planted in corn in 2020 was 41.26 million hectares, 6.6 million hectares above the target set in 2015.

The area planted in corn this year is 43.32 million hectares, just 1.6 million hectares below the 2015 peak that produced a huge glut of corn.

Corn is also leading the way in this year's grain imports, with 26 million metric tons imported in the first ten months of 2021. This year's corn imports (so far) are triple the 7.8 mmt imported in the first ten months of last year and more than double the 11.6-mmt increase in this year's corn output.

The statistics bureau spokesperson noted that the expanded plantings of high-yielding corn contributed to the growth in overall grain output. Chinese farmers added over 2 million hectares of corn (with a yield of 6.29 kg/ha) and reduced area planted in soybeans by 1.47 million hectares (with a yield of 1.95 kg/ha).

China's Seed Nationalism

China is scouring the countryside to find native seed, animal and fish genetic resources in a national germplasm census according to Economy Daily, a communist party news outlet. The purpose is to protect "family property" and gain self-reliance in crop and animal breeding. "Excellent" plant and animal resources will be protected on company-run farms if they are in danger of extinction or turned over to Chinese seed and breeding companies to exploit their commercial potential to propel Chinese seed companies as global competitors.

Improvement of China's seed industry is one of the national priorities set at last December's planning meeting for economic work this year. The germplasm census launched in March 2021 was one of the activities ordered by this year's "Document Number One" issued by China's central communist party leadership. The germplasm census is expected to be completed in 3 years. The activity is canvassing all Chinese counties to draw up a list of plant, livestock-poultry, and aquatic animal germplasm. Today, an expert committee was charged with identifying 10 major plant resources, 10 major livestock/poultry resources, and 10 major aquatic animal resources.

An agriculture ministry official said, "Some of these resources are old, some are rare and endangered, and some carry farming civilization and traditional culture; [the activity] fills gaps in the census of livestock and poultry genetic resources on the Qinghai-Tibet Plateau."

As an example, the official cited abundant sheep resources of the Tibetan plateau, including animals adapted to high altitude, rough fodder, disease resistance and strong physique. Others include several species of fish in the Yangtze River, a duck from Zhongshan, and a Shanghai water buffalo breed.

A National Crop Germplasm Bank was established at the Institute of Crop Science of the Chinese Academy of Agricultural Sciences. Data will be archived, digitized, and accessible via intelligent computing, according to Economy Daily. Plans include nine regional gene banks in key provinces and a national livestock and poultry germplasm resource bank.

Foreign research institutes and multinational companies should not expect to gain easy access to these resources. Economy Daily calls germplasm "family property." Economy Daily emphasizes that "control of germplasm resources and self-reliance are urgent tasks of great significance in the fight for a good turnaround in the seed industry and to promote the revitalization of the seed industry.

The next step will be for agriculture ministry authorities to conduct performance testing of the germplasm resources to evaluate their commercial potential for breeding new varieties.

It was probably not coincidental that the Economy Daily article came several days after last week's Ministry of Agriculture and Rural Affairs meeting to emphasize progress on supporting China's seed industry to create a strong backbone industry chaired by Minister Tang Renjian. The meeting considered how to implement Xi Jinping's important directive to "concentrate resources, science and technology, personnel, and capital in key seed companies...to accelerate a new pattern for their development." The meeting emphasized that companies are the main innovators and are expected to supply "their own seeds" to the market, become internationally-competitive dragon heads, and a few should emerge as "aircraft carriers" in the global seed industry. The meeting called for supporting R&D and strengthening seed/breed resources for corn, soybean, swine, and dairy cattle breeding where Chinese companies are behind foreign counterparts.

Central and local authorities should encourage and guide research institutes, banks, and production bases to link up with seed companies to help them develop through the "two hands" of market and government and protect intellectual property rights by cracking down on fake seeds. Officials were ordered to craft policies to support specific companies. Companies were ordered to seize opportunities, pool resources, and work toward national objectives of self-reliance in seed resources, upgrading science and technology, and raising China's core competitiveness in the seed industry.

108 companies have 25% of China's sows

Just 108 companies now control a fourth of China's swine production capacity, according to a list prepared for a recent swine industry forum. Unpredictable gyrations in China's hog market continue with the influx of big pig farmers, contrary to the expectations of agricultural officials.

Pigs have historically been scattered across millions of backyard pens, sheds, and living rooms in Chinese villages. At the peak of backyard pig-farming, China's 1997 agricultural census counted over 130 million rural households raising pigs--usually one or two at a time--and those small family holdings accounted for 95 percent of the swine inventory.

In recent years a handful of companies have been on a hog-farm construction binge. Their expansion accelerated during a 2014-17 environmental regulatory push that shut down hundreds of thousands of small farms. Then the African swine fever epidemic wiped out millions more of small farms, biosecurity requirements and a new round of subsidies favored big companies, and "pig concept" stocks became fashionable, attracting billions of dollars of capital investment.

A list of 108 companies with at least 10,000 sows was compiled for the 7th China swine industry summit based on company financial reports, industry news, and unpublished sources. The combined sow inventory of the 108 companies as of October-November 2021 was 11.79 million head. That's about a fourth of the 44.79-million-head national sow inventory reported by the China National Bureau of Statistics' as of the end of September.

|

| List prepared for 7th China High-level swine industry forum. |

Muyuan Foods Group was the clear number-one company, with 2.7 million sows. Three other companies--Wens Foodstuff, New Hope-Liuhe, and Zhengbang Technology--were listed with 1 million or more sows. These top four companies had a combined 5.9 million sows. Another 15 companies had 100,000-400,000 sows each (3.2 million sows combined), 22 companies had 50,000-90,000 sows (1.4 million combined), and 67 companies had 10,000-40,000 sows (1.2 million combined).

Muyuan pulled ahead of the competition during the African swine fever crisis. A ranking from 2016 showed Wens produced more than 5 times as many hogs as Muyuan and Zhengbang, and a 2019 ranking still showed Wens in the top spot. Muyuan now has 2.7 million sows, more than double Wens' 1.2 million.

For years Chinese agricultural officials have blamed small farmers for constant booms and busts in the hog industry--"blindly" expanding when prices are high and then killing off sows when prices drop. However, the influx of gigantic farms has perpetuated industry gyrations.

Chinese rural news outlet Nongcai Baodian reported that China's swine industry still has excess capacity, despite farms having culled many low-productivity sows and cleared out overweight hogs after prices plummeted 50 percent in the first half of 2021. A medium-sized pig farmer in Henan Province attributed low prices in early October to "too many pigs on the market." He estimated that less than 10 percent of hogs had been produced by companies before ASF, but their share is now 20-30 percent. Hog traders told the reporter that big companies piled in when hog prices were high, with one scaled-up farm replacing dozens or even a thousand small-scale farms. The report ascertained that companies are optimistic about next year's market. While they had culled many of their low-productivity sows, they replaced them with a roughly equal number of new gilts.

The description accompanying the swine industry forum list said that hog farming companies have culled large numbers of sows and abandoned construction projects since hog prices began dropping early in 2021. The report estimates that 150 companies had 10,000 sows at the beginning of the year, but the number dropped to 108 due to culling of unprofitable sows. The report estimates that the top 108 farms are operating at just two-thirds of their capacity--a third of barns and stalls are empty due to the crash in prices this year.

The report estimated that the current population of sows could produce 235.8 million finished hogs if each produced 20 marketed hogs per year. Hogs raised from a sow bred now would be ready for market in September 2022.

Earlier this month Muyuan held a Q&A to reassure investors--about 15 investment funds, securities firms, and insurance companies. Cost-cutting, retirement of sows, capital expenditure plans and financial stability were the main topics. Muyuan assured investors that cash flow is normal, but also explained that the company had suspended all construction projects that were less than half-finished and is evaluating others on a case-by-case basis. The company is rushing to complete construction of slaughterhouses before the spring festival holiday. The new facilities would bring its slaughter capacity to 20 million head annually. The company hopes to reverse its losses on its slaughter business in 2022. Muyuan reported a ratio of pigs per sow of 24, suggesting its sow inventory can produce 64.8 million finished hogs. The company has 135,000 employees, enough to fully staff the new slaughterhouses, the company said.

Pork Conglomerate Corporate Welfare

The tentacles of subsidies and government aid are entwined with the world's largest hog farmer. China's Muyuan Food Group--an ostensibly private company--has sold more than 31 million swine through October this year. If Muyuan hits the top range of its targeted output of 35-to-45 million head this year--it will come close to matching the entire production of Brazil or Russia.

Last week local communist party authorities in Nanyang City of Henan Province--Muyuan's hometown--issued a document calling for 15 policy measures to support Muyuan with the goal of propelling the company into the Fortune-500 list of the top companies in the world. The policies feature measures that are invisible to outsiders. They include central government transfer payments for hog-producing counties and manure utilization demonstration projects, easing up on land-use planning and environmental assessments, local government loan guarantees, aid for constructing breeding centers, industrial parks, logistics hubs, slaughterhouses and subsidiary companies operating in ancillary industries like feed-milling and equipment manufacturing.

First, the document orders local county and district authorities to continue implementing policies launched in 2019 to restore hog production capacity from losses during the industry's African swine fever crisis. This includes behind-the-scenes coordination that orders land-use planners, environmental departments, financial regulators, banks, insurance companies, vaccine manufacturers, and transportation officials to incorporate Muyuan's giant hog farms and ancillary operations in their plans and give them favorable treatment.

The document orders local leaders to expedite and streamline license applications for building farms and slaughter facilities, business licenses for breeding farms and feed mills, inspection and quarantine permits. Officials are instructed to coordinate with environmental departments--presumably to prevent any delays or hold-ups.

Local officials are instructed to make land available for Muyuan to finish building its planned layout of breeding and commercial farms, slaughterhouses, feed mills, and industrial parks. Leaders must facilitate the transfer of farmers' land and village collective land and solve conflicts over land use. Grass roots leaders and common people are to undergo "thought work" to smooth out the land transfer process.

County and township meat and animal inspectors are expected to design their work with Muyuan's needs in mind, ensuring that animals are slaughtered in a timely way and qualified for slaughter.

Authorities are ordered to provide guidance to Muyuan in implementing measures apparently meant to certify disease-free zones: "Non-regulated animal disease zones" and "African swine fever-free zones."

An emphasis on breeding and promoting local specialty breeds reflects a priority set 11 months ago that called breeding stock the "silicon chips" of hog production. Local officials are ordered to provide unspecified support in constructing Muyuan's chain of breeding farms -- grandparent farms -- multiplier farms -- commercial finishing farms to meet the demand for breeding animals. Muyuan's plan includes protecting a local breed of "Nanyang black pig" and incorporating its genetics in specialty commercial breeds.

China has big ambitions to be a first-mover in application of information technology and artificial intelligence in farming. Officials are ordered to spend money on to help Muyuan incorporate information technology, R&D on intelligent equipment, big data, cloud computing, Internet of things platforms, explore 5G-plus, real-time weather monitoring, and digitization of production and management systems.

Four counties in Nanyang's region are pilot areas for manure utilization. The pilots will engage a Muyuan subsidiary company as a "third party" in manure treatment--with policy support funds. The projects are expected to demonstrate treatment and use of animal waste, using it to replace chemical fertilizer and to improve land quality in a green "circular" model.

Human resource development includes training motivated, educated rural people in technical and business skills to meet Muyuan's needs for high quality farmers and employees.

Equipment needed for swine farms and associated activities will be included in the local list of items eligible for the farm machinery and equipment subsidy.

Nanyang will guide Muyuan in supporting construction of high-efficiency water-conserving irrigation projects and high-standard fields to preserve national food security. Presumably, this is a quid-pro-quo for turning huge swathes of farmland over to Muyuan for its hog farms and...industrial parks--another featured rural development strategy this year.

Local officials will "guide" Muyuan to build industrial parks focused on meat, agricultural and livestock equipment manufacturing, a "food city", an agro-ecological demonstration park, and e-commerce off-line exhibition center, and a smart logistics park.

A Nanyang City meat industry upgrade plan aims to create the largest hog-producing, meat processing, cold-storage, and farming-livestock equipment manufacturing centers in the country, plus add an international livestock technology exchange center in Nanyang.

This year Henan Province issued a document endorsing government credit guarantees for farm loans. Officials intend to propel hog industry development via behind-the-scenes coordination of banking and insurance regulators, the Agricultural Bank, Postal Savings Bank, and by creating a government guarantee company to leverage bank loans and investment.

Last, but not least, is control of information. The government will closely monitor everything Muyuan does and will issue propaganda through news media to "rationally guide market expectations." Officials will guide Muyuan Group to follow national hog industry policy, adjust the hog population structure, and continually raise and improve hog production capacity.

The local support announcement comes after a patch of losses for Muyuan and other big pig companies in China due to excess capacity and plunging prices in 2021. One commentary described a "crazy" month of October in which hog prices plunged to 10.5 yuan per kg, then rebounded to 15.8 yuan by the end of the month. Muyuan's share price lost half its value during the crash in hog prices from March to August. A 35-percent rebound in September-November paralleled the rebound in hog prices.

|

| data from finance.Yahoo.com |

Muyuan dumped over 5.25 million hogs into the market during October--up from 3.1 million head sold in September. The average sale price was 11.88 yuan/kg (about $.86 /lb), well below Muyuan's breakeven price of 15 yuan/kg ($1.06 /lb.) By comparison, the average U.S. hog price is currently $.75 per lb. The breakeven price for China's most successful hog conglomerate is 40 percent above the U.S. price.

The commentator estimated that Muyuan might have lost over 2 billion yuan (around $312 million) during the month of October by selling 5.25 million head below the breakeven price. Eight of the other nine big pig-farming companies also upped their sales in October.

The commentator wondered what was behind the odd business decisions and price fluctuations. He speculated that the companies are making a "last stand" at the end of the year to optimize the numbers for their annual reports for skeptical investors to prevent share prices from tanking.

Blizzards Could Affect China's Corn Marketing

China Food Prices Down; Energy Prices Soar

China had 1.5-percent growth in consumer prices over the past 12 months according to its October 2021 Consumer Price Index (CPI) report. The U.S. CPI showed 6.2-percent growth over the same period.

The food component of China's CPI was down 2.4 percent over 12 months while its nonfood component was up 2.4 percent. By comparison, the food component of the U.S. CPI was up 5.3%.

|

| Source: China National Bureau of Statistics. |

The decline in the food component of China's CPI is entirely due to the popping of China's pork price bubble. Pork prices in October were down 44 percent from a year ago. Most Chinese food prices rose by 2 percent or less over the past 12 months. Consumer prices for grain products were up just 0.9 percent. A handful of food items rose more than 5 percent: vegetables by 15.9 percent; eggs by 12.6 percent; fish by 8.3 percent; and edible oil by 6.4 percent.

Energy commodities propelled the rise in consumer prices. The fuel component of China's CPI was up 31 percent from last year. The energy component of the U.S. CPI was up by a nearly identical amount: 30 percent.

China's inflationary momentum is concentrated in producer prices for energy and industrial commodities. China's October Producer Price Index (PPI) was up 13.5 percent. Ex-factory prices for coal were up 103.7 percent from a year ago and petroleum and gas were up 59 percent. Producer purchase prices for fuel were up 40.7 percent, ferrous metals were up 22.6 percent, and nonferrous metals were up 25.8 percent, and chemicals were up 24.9 percent.

Producer purchase prices for products of agricultural processing were up 2.6 percent from last year, and prices for processed food were up 2.7 percent. Producer purchase prices for textiles were up 8.5 percent, but purchase prices for clothing were up just 0.8 percent.

China's pork prices have come down from the stratosphere. Purchase prices for hogs began their slide early in 2021. Hog prices bottomed out at 10.5 yuan per kg. in early October, then rebounded to 15.8 yuan later in the month. Hog prices are about half the prices reported a year earlier in October 2020 and about the same as in early 2019. Pork prices have followed the same path.

|

| Source: China National Bureau of Statistics industrial purchase prices. |

China's corn prices surged in 2020 and early 2021, but the upward momentum dissipated over the course of this year. The surge of corn imports since last year probably cooled off the upward momentum in corn prices, and falling hog prices may have pulled corn downward. Feed use of wheat bolstered wheat prices slightly as corn prices rose above wheat prices early this year. In October, the corn price was once again slightly below the wheat price. In contrast, China's rice prices have been weak since the fall harvest began, and a number of provinces have begun purchasing both indica and japonica rice at minimum prices.

|

| Source: China National Bureau of Statistics industrial purchase prices. |

What worries Chinese officials is the potential for rising fertilizer and fuel prices to pinch farmers' profit margins as they plant crops to be planted in 2022.

Agriculture in China's Free Trade Agreement Strategy

A global network of high-standard free trade areas is one of the components of China's 14th five-year plan. A recent Farmers Daily article by a staff member at the agriculture ministry's trade promotion center explained the strategic role of agriculture in China's pursuit of regional free trade agreements (FTAs). The article appears to be part of a flurry of articles aimed at boosting China's ambitions to join the RCEP agreement set to take effect next year.

The author explained that FTAs and the multilateral trading system are two wheels of the globalized economy. In 2002, China began negotiating its first FTA with ASEAN, the southeast Asian trading bloc--immediately after joining the WTO. By the end of 2020 China had 19 FTAs with 26 countries and regions. Agriculture plays an important role in China's FTA strategy, the author claimed.

Agriculture has generally played a relatively minor role in China's FTAs. A perusal of China's FTA partners listed on a special FTA section of the Ministry of Commerce website includes many countries like Mauritius, Maldives, Georgia, Bangladesh, Switzerland, South Korea, and Iceland that are not major agricultural exporters. Similarly, other FTAs being negotiated include countries like Sri Lanka, Israel, Norway, Moldova, and Panama that are not known as food exporters. The Phase One agreement with the United States is not mentioned, nor is the U.S. mentioned even as a prospective FTA partner. Canada is the only major ag exporter listed as an FTA under study, but farm exporters Brazil, Ukraine, Argentina, and Russia are not on the list.

The author explained that China has used several different strategies for farm commodities in FTA negotiations in view of agriculture's role in national food security and boosting incomes of rural people.

Two big agricultural exporters that do have FTAs with China are Australia and New Zealand. The author explained that China carefully guards agricultural interests when making deals with agricultural exporters who view access to China's market as a major objective. The author said that 20 rounds of negotiation with Australia were drawn out over 10 years with dozens of technical consultations. China struggled to exclude sensitive commodities like grains, cotton, oilseeds, and sugar from tariff cuts. Tariff cuts for wool, beef mutton and dairy were stretched over a longer phase-in period and protective measures were added. For less sensitive products like fish, shellfish and fruit, China granted Australian proposals to speed up tariff cuts.

While not mentioned in the article, dairy products, fruit, and fish from New Zealand, Chile and Peru have gained greater access to China's market with tariffs cut to zero over about seven years by FTAs.

In contrast, China's opportunities to export agricultural products was a chief benefit of the FTA with South Korea. The author said China's industry was vulnerable to competition from South Korean manufacturers of items like automobiles and petroleum. He said China stuck to its strategy of balancing overall interests in trade negotiations by balancing benefits from agricultural exports to South Korea while using leverage to reduce South Korean demands for opening industrial markets.

In China's ASEAN FTA, agriculture played a role as demonstration role as a sector targeted for fast-track tariff reduction through an "early harvest" agreement that cut tariffs on agricultural products faster than tariffs on industrial and consumer goods. Vegetables, fruit, and aquaproducts saw rapid growth in the early years of trade with ASEAN. China's imports of fruit are probably the biggest component of this trade. China's rice imports from Southeast Asia were slower to take off, but they also boomed in the last ten years. China cut its out-of-quota tariff on rice from 65% to 50% for ASEAN exporters. China's tariffs for broken rice are now just 5% for ASEAN countries and the MFN tariff is 10% for other countries.

It's no surprise that China carefully manages its FTAs to protect agricultural interests. This is not unfettered free trade. FTAs must consolidate China's food security, ensure core points and interests in agriculture, and satisfy both parties' basic interests, the author said.

Bail Out the Bankrupt; Keep the Masses Fed and Warm

After hearing a report on an inspection of 16 provinces, China's Premier Li Keqiang ordered officials to help major companies escape financial ruin, plug holes in local government finances, and keep the masses fed and warm. Behind the scenes, officials are worried that Olympic ice skaters will have enough vegetables to eat.

Premier Li's top priority at the November 2 meeting was to help major market players alleviate "new" financial difficulties and fine-tune an economy facing "new downward pressure." Specific problems he cited include unpaid debts to small and medium enterprises, financial problems for some local governments, and rising costs due to soaring commodity prices.

The second priority is to address "pain points" for the common people, including unpaid wages for teachers, unpaid medical expenses, reconstruction of aging residential communities, and other "unsolved problems" related to maintaining the basic standard of living. This includes stabilizing food supplies and prices and keeping people warm through the winter.

Third, Premier Li took aim at waste of government funds, calling for an end to "face" projects. Instead "valuable public funds" should support market players and maintain peoples' basic living standard. The meeting called upon officials to refrain from formalism and bureaucracy, and to resolutely oppose inaction, reckless action, "mean government" and "lazy government".

On cue, other Chinese Government organizations have released documents this week calling for vigilance in stabilizing supplies of basic necessities.

A November 1 notice on ensuring supply of vegetables and other daily necessities over the winter issued by the commerce ministry encouraged families to stock up on basic staples in case of emergency. The notice was interpreted by many Chinese citizens as a signal that the country was about to invade Taiwan, and it become the most-discussed topic on social media.

A rebuttal posted by China Grain Net berated netizens for "over-interpreting" the commerce ministry's notice as an invasion warning. The article explained that such notices are commonly issued, and this one was prompted by flooding and other weather events, rising vegetable prices, the pandemic, and the possibility of more weather events driven by a prospective La Nina. The advice to stock up on necessities was given in case citizens encounter covid lockdowns, the article explained.

An October 29 notice on winter vegetable production and marketing issued by the Ministry of Agriculture and Rural Affairs explained that vegetable prices had been rising due to extreme weather since September, virus prevention, rising production costs, and power cuts. The Ministry ordered officials to ensure vegetable supplies to cities, especially during the winter holidays and the Beijing winter Olympics.

Winter and spring agricultural supply was the theme of a November 4 Ministry of Agriculture and Rural Affairs news conference. Market Information Director Tang Ke explained that China had experienced nearly unprecedented flooding this fall, and 2 million mu of vegetable fields are still waterlogged or flooded. Lack of sunshine has slowed growth, especially effecting leafy vegetables like spinach and lettuce. Tang cited rising fertilizer and pesticide prices for raising vegetable production costs, disruption of transportation by rising fuel costs, power cuts that wiped out seedlings in greenhouses, and disruptions from the spread of the virus in some areas.

The deputy director of the Ministry's crop production office assured the public that increases in grain production in northeastern provinces and elsewhere offset losses to flooding in Henan, Shanxi, and Shaanxi Provinces. The Ministry expects a record grain output this year, and the crop office director claimed that supply is greater than consumption. She acknowledged that rain had slowed the planting of winter wheat, but claimed planting had been expedited after weather improved in mid-October. Now the risk is that the late planting will affect the crop's progress.

The head of the Ag Ministry's veterinary bureau said pork is also in surplus, with the 30 million head slaughtered at above-scale facilities in October up 110 percent from a year earlier and the 46-million-head sow herd 6 percent above its equilibrium size. His good news is that a bump in hog prices in October restored profitability for hog farmers. He encouraged everyone to eat more pork to improve their nutrition (perhaps he didn't read the State Council's dietary guidelines that encouraged people to eat less pork and more whole grains, leafy vegetables and soybeans).

On November 3, the director of the Administration of Grain and Commodity Reserves assured the public that wheat and rice reserves are adequate. He said grain reserves are at a historic high. Rice and wheat make up 70 percent of government grain reserves, and there is 1.5 years' supply of wheat in reserves.

Chinese Land Sales Income to be Redirected to Countryside

Chinese real estate creates riches out of thin air by seizing rural land on the urban fringe, re-classifying it as "state-owned," selling it, building on it, and reselling it, padding its value each time. This process has created countless millionaires and bolstered municipal finances. Now Chinese officials have belatedly decreed that a larger share of those riches should be returned to the countryside to support agriculture and rural infrastructure.

A document issued in September 2020 decreed that the 50 percent of income from sales of requisitioned land should be earmarked for agricultural and rural use by the end of the 14th five-year plan in 2025.

At a press conference on the document last year a rural policy team headed by former rural development czar Han Jun (now governor of Jilin Province) estimated that the average share had been 34 percent during 2013-18. Han's task force estimated that increasing the share by 1 percentage point would generate 60-70 billion yuan (roughly $10 billion) for rural revitalization every year.

|

| Source: Jiemian.com. |

The 2019 "Number one document" on rural policy first called for raising the proportion of land sales used for rural development. The 2021 document included one sentence in a paragraph on financing rural development that called for an evaluation system for devoting income from land sales to agricultural and rural spending, but no specifics or numbers.

Last month a videoconference was held in Beijing to discuss how to reach the 50% objective set by the 2020 document. The brief report on the meeting did not reveal any specifics.

Redirecting land sales income to the countryside turns out to be a lot more challenging than it sounds.

First of all, the 50% objective is nowhere near half of the gross value of land sales--it's 50% of what's left after paying for the land and paying for demolition.

Yicai, a Chinese business news outlet, said last week that gross income from sales of requisitioned land soared from 50 billion yuan in 1998--when China's housing was first marketized--to 8.4 trillion yuan in 2020, about 8.3% of China's GDP. The value of annual land sales happens to be a little more than "primary industry" GDP of 7.7 trillion yuan--a rough measure of agricultural net output. Yicai commented that local governments hit by impacts of the pandemic last year were under pressure to fill gaps between shrinking income and ballooning expenditure with funds from land sales.

Yicai noted that there are considerable costs deducted from land sales. A securities research institute in Guangdong found that 52% of land sales income is used for compensation and demolition. They did not elaborate on who was compensated, but probably just a fraction went to villagers who collectively "owned" the land. Another 23% was used for "land consolidation", 12% for urban construction, and just 1% for rural infrastructure, leaving little for discretionary spending, the institute found.

The rural revitalization task force reported last year that cumulative gross income from land sales was 28 trillion yuan between 2013 and 2018, but only 5.4 trillion yuan was left after deducting costs of compensation and demolition. The team estimated that 1.85 trillion yuan was used for rural spending--about a third of net land sales but only 6.6% of gross sales.

Moreover, Han Jun reported that some localities inflate costs and under-report their gross land sales income. His team designed a "digital accrual" scheme to outflank them.

The Guangdong securities institute found that a few coastal provinces take in the largest amount of funds from land sales. Jiangsu and Zhejiang Provinces were the top two, reaping over 800 billion yuan each in 2019. Shandong and Guangdong Provinces took in 500-600 billion yuan each, and the next 10 provinces earned 150-300 billion yuan. Many of these provinces financed all of their local expenditures with land sales income.

In contrast, provinces in China's western and northeastern regions earned relatively little from land sales. These provinces are accordingly in weaker financial condition and rely on transfers from the central government and tax refunds.

Redistributing the land sales pot of gold involves a tug of war between multiple government ministries and different levels of government whose interests are not always aligned. Last month's videoconference included the Minister of Agriculture and Rural Affairs, a Vice Minister of Finance, deputy director of the national rural revitalization administration, and officials from the National Development and Reform Commission, State Tax Administration, and Jilin, Inner Mongolia, Anhui, and Guizhou Provinces participated.

A report on land management from Jiangsu Province's standing committee last week reveals the challenges of juggling priorities in land allocation. The report cited a contradiction between "twin bottlenecks" of economic development and protecting land resources, plus a jumble of industrial, agricultural, housing, energy-conservation, and environmental protection zoning plans and priorities. Cities and industrial parks need land to fulfill plans for housing developments, ecological protection, "industry chains" and "industry clusters", while officials are under orders to delineate "permanent basic farmland," prevent loss of farmland and to prevent farmland from being used for non-grain crops. The Jiangsu report calls for addressing lingering "historical" problems, including construction of villas and hotels inside greenhouses to comply with farmland development restrictions, disputes over land with Taiwan-invested companies, and registration of land belonging to religious organizations.

Soggy Fields and Costly Farm Inputs Affect China's Corn and Wheat

Chinese leaders are worried that flooded fields and soaring farm input prices are slowing the corn harvest and planting of the winter wheat crop.

Sustained heavy rains and other anomalous weather events--including giant hail, tornadoes, and snow in August--have occurred all over northern China since the summer months. Many fields remain waterlogged or flooded, creating a double threat of suppressing the fall harvest of corn and delaying or preventing the planting of winter wheat.

|

| Flooded corn field in Shandong Province, September 26, 2021. Source: iqilu Shandong news service. |

The standing committee of China's State Council held an October 20 meeting that ordered officials to take measures to ensure that fall grain is harvested and to speed up the planting of winter wheat. The top leadership promised to give strong support for completion of fall harvest and planting of over-wintering crops to ensure food security and commodity price stability.

According to Yicai, an official business news outlet, wet and muddy fields delayed harvest of grain and raised the cost of operating mechanical harvesters. Videos show corn stalks in standing water as much as a meter deep and farmers filling floating tubs with corn cobs. The agriculture ministry says 75 percent of the fall grain has been harvested, 4 percentage points less than usual. The cost of harvesting corn rose to about 50-to-100 yuan per mu (about $47-$93 per acre).

|

| Corn harvested in Shanxi Province. |

Wet field conditions are having a more serious impact on planting of winter wheat. The ag ministry says wheat-planting is 26 percent complete, about half the usual progress. A ministry official warned at an October 20 news conference that the delay reduces the accumulated temperature-days for wheat seedlings to sprout and become established before winter sets in. Late planting could affect the wheat's growth next spring and excess soil moisture is conducive to disease and pests. Some fields still have standing water and may not be planted at all.

Officials are also worried about how soaring prices of chemical fertilizer, pesticide, fuel and other inputs will affect farmers' income and production incentives. Yicai says the price of nitrogenous fertilizer has risen 25 percent since spring planting and phosphate fertilizer has risen 30 percent. The increase in fertilizer price is estimated to increase the cost of wheat production by the equivalent of 100-200 yuan (about $15-$30) per metric ton.

|

| Indexes calculated using National Bureau of Statistics raw material purchase prices. |

The State Council ordered officials to organize the procurement, drying and storage of corn. Their second responsibility is to ensure the planting of winter wheat by draining fields, choosing early-maturing varieties, applying extra fertilizer, and advising farmers on field management. The State Council instructed officials to maintain fertilizer supplies, stabilize input prices, adjust imports and exports, and monitor the quantity and quality of seeds.

Agricultural officials have been ordered to drain fields, subsidize grain-drying equipment, ensure electricity supplies, and to speed up winter wheat-planting. They should use existing funds and finance departments should pass down next year's funds for aid to agricultural counties and machinery and equipment purchase subsidy funds to finance the disaster mitigation activities. A June 18 State Council meeting approved an extra 20-billion yuan in one-time subsidies for grain-planting farmers to compensate them for more costly farm inputs.

The Ministry of Agriculture and Rural Affairs has assigned each of its top leaders responsibility for one province each of the seven targeted for assistance in grain harvest and wheat planting: Hebei, Shandong, Henan, Jiangsu, Anhui, Shaanxi, and Shanxi Provinces. Local news media report that communist party officials are organizing teams to dredge ditches, draining fields with earth-moving equipment, and giving advice to farmers for harvesting corn and planting wheat.

|

| Pumps supplied by firemen drained fields in a county of western Heilongjiang. Source: The Paper. |

China Pork: Shortage to Glut in Two Years

China's swine industry is in liquidation mode exactly two years after hog supplies cratered in the fall of 2019. In August 2019, a vice premier ordered officials to build hog farms to replenish pork supplies asap. Now the same officials are being ordered to pare back herds in their provinces and counties.

China's Economic Weekly reported that six of the top hog-producing companies in China reported losses for the third quarter of 2021. That includes a loss of 500 million to 1 billion yuan for the largest company, Muyuan, a loss of 2.58-2.98 billion yuan for New Hope Group, and a loss of 6.75-7.25 billion yuan for Wens Foods. In Hunan Province, farms are reportedly taking losses by selling weaned pigs to barbecue restaurants because the farms would lose even more by raising them to slaughter weight.

The pork glut is an outcome of frenzied expansion. Last year the chairman of hog company Tangrenshen told Economic Weekly that companies like his planned to add production capacity totaling 2 billion head, more than three times annual consumption of about 650 million head. A September 2021 notice issued by an organization overseeing the Hunan Province livestock industry warned that many big farm projects have been abandoned, leaving creditors and prospective contractors in the lurch, dodging their "social responsibility" and creating a "hidden risk."

At a press conference this week, the Ministry of Agriculture and Rural Affairs noted that the pork surplus is so serious that hog prices did not rebound during the peak mid-Autumn festival and National Day holidays, and farms of all types are incurring deep losses. The Ministry estimates that the swine sector has about 10% surplus production capacity and reports that sow numbers have fallen three months in a row since July. A Ministry official suggested farms cull one low-productivity sow from every ten in the herd, cull one extra runt from each litter, and slaughter fattened hogs 10 days early. The Ministry reported that the number of hogs slaughtered at above-scale facilities in the first nine months of 2021 was up 61 percent from the previous year, and slaughter at those facilities in September 2021 was up 95 percent year on year.

According to the National Bureau of Statistics, 492 million hogs were slaughtered in the first nine months of 2021. That's 36-percent more than were slaughtered in the same period of 2020, but about the same as production in 2018--before the African swine fever epidemic decimated the herd. The Bureau reported that third quarter 2021 hog prices were down 55.5 percent year on year.

How is it that China's pork market has reached a saturation point with deeply depressed prices with production about the same as two years ago? China's pork output for January-September 2021 was reported to be 39.2 mmt--up 10.8 mmt from the same period in 2020. This year's pork output so far is about the same as during the same period of 2018--before the African swine fever epidemic began.

A broader view including meat imports and production of other meats shows the overall meat supply is up about 14 percent from 2018. The greater supply of pork alternatives and crimped travel and food service from strict covid-19 lockdowns cutting into demand could explain why China's pork market is saturated.

China has the dubious distinction of being not only the biggest pork producer and consumer in the world, but also the highest-cost producer. Imports now constitute a significant portion of supply. China's 3 million metric tons of imported pork so far in 2021 constitutes about 7 percent of the pork supply. The 7.5 mmt of all meat and offal imported in the first nine months of 2021 constitutes 11 percent of the country's January-September meat supply.

Targets set last year call for limiting pork imports to 5 percent or less of the supply and beef and mutton imports at 15 percent.

The Ministry of Agriculture and Rural Affairs is now instructing local authorities to issue warnings to hog farmers about market conditions and to urge them to pare back their herds. At the same time, the government says it is retaining policies subsidizing the industry--favorable access to village land for hog farms, special treatment in enforcement of environmental regulations, earmarked and subsidized loans, and subsidized insurance.

China Promises to Rescue WTO

Chinese officials are promising to rescue the global trading system as they celebrate the country's 20th year as a World Trade Organization (WTO) member. While China spent its early years in the WTO watching and learning, confident leaders now seem to be maneuvering toward a more proactive role as a leader of the organization.

Last week a forum was held by China's agriculture ministry to discuss the country's agricultural development in the 20 years since it joined the WTO. Deputy Agriculture Minister Ma Youxiang emphasized that China's agriculture had "withstood" multiple tests of a global food crisis, world financial crisis, and the covid-19 pandemic. Ma went on to praise China's achievement of "stability," and insisted that China's agriculture has become more globally competitive. Ma added that China has also enhanced its ability to participate in food and agricultural governance, code for China's ambitions to take a more proactive role in international organizations and reshape trade rules, food standards, and food aid. Ma suggested that China should now continue pushing WTO agricultural reform negotiations, promote bilateral, regional and multilateral trade negotiations, and spur exploration of innovative approaches to promoting agricultural trade.

The broad theme of China's leadership in global trade was launched in March by Foreign Minister Wang Yi's remarks on four "lessons" from 20 years as a WTO member. Foreign Minister Wang insisted that China must remain an open economy to build on its achievements in foreign trade, and stick to a win-win approach to trade and globalization. Wang said China must not respond to challenges by withdrawing into protectionism or by decoupling. He praised the WTO as the the "cornerstone" of international trade and a "pillar" of global economic growth. Wang announced China's willingness to work with all countries to continuously improve the multilateral trading system and to enhance the effectiveness and authority of the WTO.

Yi Xiaojun, who recently stepped down from a term as WTO deputy director general, remarked at a May forum on the 20th anniversary of WTO membership that China's reform and opening was the best choice for resolving many contradictions the country faces in the international arena today. Yi claimed that, "China, the U.S. and Europe are roughly the same in terms of abiding by the rules and fulfilling their promises." Long Yongtu, lead negotiator for China's WTO accession, asserted that China's membership had changed the WTO's pattern and direction, and he claimed the United States was one of the biggest beneficiaries. Long added, "China has not lost its commitment to a socialist market economy, nor has it lost [its vision for] opening up developing countries."

|

| Lead negotiator for WTO accession, Long Yongtu, and former WTO deputy director general, Yi Xiaojun, praised China's WTO membership at an August 2021 forum. Source: southcn.com. |

In August, Deputy Commerce Minister and trade negotiator Wang Shouwen suggested that China could rescue the WTO from its current "predicament." Again citing the 20th anniversary of China's membership, Wang Shouwen warned that the WTO system's "effectiveness and authority" had been undermined by paralysis of the appellate body and politicization of trade issues by "individual countries" who adopt "unilateral and protectionist practices." Wang cited examples of China's contribution to a trade facilitation initiative at the 2013 Bali ministerial, support of an agreement to end agricultural export subsidies at the 2015 Nairobi, and participation in negotiations on investment, e-commerce, and small and medium enterprises.

Wang Shouwen promised that China would form a "new development pattern" to promote "high-level opening to the outside world." China has high hopes for strengthening WTO’s effectiveness and authority through progress on fishing subsidies, trade and health, appellate body reform, trade in services, facilitation of foreign investment, and e-commerce, Wang said. He added standard talking points that China is willing to work with all countries to promote economic globalization in an "open, inclusive, inclusive, balanced, and win-win direction."

Last week a Tsinghua University scholar explained that China's "opening" process is moving in historical stages. A "progressive advancement" stage began in 1979 with establishment of "special economic zones," reduction of tariffs, elimination of quotas and import licensing, a "go west" campaign to filter benefits of trade to western provinces, and membership in the WTO in 2001. His muddled explanation culminated in a stage of "systemic reform" adopted in 2018 to reform rules, regulations, management, and standards to promote openness [seems like this was supposed to happen with WTO membership]. Interestingly, the professor revives the "decisive role of the market in resource allocation" slogan adopted when Xi Jinping ascended to leadership in 2012 that later went missing.

The talking points emphasize that China's "national features" of "win-win" trade and a fair trading environment for developing countries influence its unique approach to reshaping the multilateral trading system. However, a concerning "Chinese feature" is its tendency to cynically take WTO-approved measures meant to liberalize trade and repurpose them as release valves that can be opened or shut to adjust the volume of imports as a market stabilizer. Chinese academic and government writings refer to this function with the oblique Chinese term "调空" but never define it.

For example, when China joined WTO it agreed to adopt tariff rate quotas (TRQs) for grains, cotton, and sugar. TRQs are a complex mechanism invented by trade reformers in the 1990s to pry open agricultural markets sealed off by quotas, licensing and other nontariff barriers. However, Chinese officials view TRQs as a valve they can open or close at their discretion to protect domestic markets or supplement domestic supplies. In 2014, an earlier Chinese vice minister of agriculture told Farmers Daily that China opposed a WTO initiative to demand transparency in TRQ management and penalize countries that never filled their TRQs. The Chinese official explained that TRQs were one of the few tools China could use to limit imports and protect its markets from global fluctuations. Government and academic authors in China continued to describe TRQs in this manner until the United States brought a WTO case challenging China's opaque administration of its grain TRQs. The legal exchanges in the case forced China to reveal that its officials had routinely turned over most of the wheat and corn import quotas to a state-trading enterprise that was not subject to the same tedious requirements imposed on private companies that applied for a piece of the quota. China claims to have corrected this, but has not explained what was done.

China agreed to set biosafety and food safety measures on the basis of scientific evidence and risk analysis. However, behind the scenes Chinese officials also advocated use of these measures as valves to control the flow of imported commodities. For example, instead of setting a percentage tolerance that would pose an insignificant risk, China demands a zero tolerance of unapproved genetically modified material in corn shipments. In late November 2013, Chinese customs inspectors suddenly began rejecting every single shipment of U.S. corn because they claimed to have found traces of an unapproved corn variety that was planted on about 5 percent of U.S. corn acres that year. The rejections continued until China magically approved the corn variety a year later.

In 2020, China decided to strictly enforce one of its many food safety requirements for Australian beef to punish Australia for demanding an investigation of the covid-19 pandemic's origins. While expressing great concern about the risks posed by Australian beef, inspectors gloss over the higher risks posed by its own beef. Last week China's top livestock official said Chinese beef producers need to be warned against the serious consequences of using "illegal additives" [i.e., growth promoters, hormones, and sub-therapeutic antibiotics], and he implied workers in the Chinese beef industry are at risk of infection from cattle diseases like brucellosis and tuberculosis that need more stringent controls in the country.

Unspoken in these public forums are China's concerns about reducing vulnerability to U.S. food embargoes; possible chokepoints in the Malacca Straits, Suez and Panama Canals; uneven regional development due to dominance of Pacific Ocean trade; and perceived U.S. dominance of the WTO and other international organizations.

China's Hog Factory Farms Taken to a New Level

In land-scarce China, swine farming companies are making a great leap to factory farming by spending billions on high-rise, high-tech hog barns up to seven stories high. With generous subsidies, Chinese officials view these farm factories as a improvement on the traditional "backyard" livestock farming model--long viewed as a road to riches for generations of rural households. However, this corporate farming model is highly experimental, still unproven, and investors probably did not count on the cratering of hog prices this year.

|

| Swine go down a ramp inside a high rise barn. |

These farms have varying designs, but they typically feature 5-7 story buildings that move pigs from floor to floor by elevator at different stages of their life cycle. Ventilation, temperature control, feeding, monitoring of pigs is often controlled by automated sensors, thermometers, and cameras. Animal waste is transported through tubes to centralized treatment facilities.

A recent article by Agriculture Industry Observer estimates nearly 200 projects to construct multi-story pig barns are in the works or already in operation. The article notes that no country has ever pursued the high-rise hog farm model to this extent and describes the current wave of investment as "exploratory."

High-rise pig facilities reduce the land footprint of farms by putting more pigs in the sky instead of spreading them across the land. In December 2019 China's agriculture and natural resource ministries jointly published a circular endorsing use of "infrastructure facilities" in agriculture to reduce land use. About the same time local governments began to aggressively subsidize construction of farms and arranged bank loans for them in a menu of 19 policies to restore hog production after the industry was decimated by African swine fever in 2018-19.

The facilities include extensive automation to address problems with biosecurity and scarce labor. They are expected to treat manure and are often paired with fruit orchards or vegetable patches where manure can be used as fertilizer in a "circular" model.

Agriculture Industry Observer described projects valued at about $1.5 billion by leading Chinese swine companies. Some examples follow:

- Muyuan, China's biggest swine farmer, is building 21 buildings in Henan Province's Neixiang district with over 2 million head capacity with investment of 148 million yuan (nearly $23 million). Muyuan says its fixed cost for high-rise buildings is 1200 yuan (about $185) per head, 20 percent more than traditional swine farms.

- New Hope-Liuhe spent 270 million yuan ($41 million) on a complex in Guang'an, Sichuan Province with places for 6,750 sows and 48,000 finishing hogs covering 42 hectares. Other projects are planned for Jiangsu and Zhejiang Provinces.

- Wens Foodstuff is spending 380 million yuan ($58 million) on a 27-hectare complex in Guangdong Province expected to produce 150,000 piglets annually in its first phase.

- Tangrenshen is spending 200 million yuan ($38.5 million) on 5 barns covering 6.1 hectares that will house 112,000 sows.

- Niuluoshan plans to make high-rise barns its "brand" with investment of 3.7 billion yuan ($569 million) on 11 hog industry chain projects.

- Capital Agriculture Group is building a 125,000-head project on 22.7 hectares in the southern outskirts of Beijing paired with a 333 hectare vegetable production base.

Oops! We canceled the corn insurance

Corn was the crop most impacted when floods covered large swathes of China's Henan Province during July 2021. It turns out that officials had canceled insurance for corn four years ago, even though corn is by far the biggest crop grown in Henan during the summer, so many farmers were not insured.

|

| Flooded fields in Henan Province in July 2021 |

This oversight was revealed in an August 16 Beijing News interview with two agricultural insurance experts from China's Academy of Agricultural Sciences which revealed numerous shortcomings in the country's huge subsidized agricultural insurance program.

The experts explained that China's agricultural insurance program is the biggest in the world. According to the Beijing News interview, premiums grew 27-fold to about $12.5 billion from its launch in 2007 to 2020--significantly larger than the U.S. agricultural insurance program. China's agricultural insurance covers 16 major commodities and 60 local specialties. Insurance covers major grain crops as well as rubber plantations, greenhouse crops, seed producers, sows, hogs, cattle, and fish. Each locality can decide which commodities are included in the program. Nearly all insurance is subsidized, with subsidies from central, provincial and local governments covering about $9.3 billion of the premiums.

In 2016, China's agricultural officials launched a 5-year campaign to cut back on corn production in a "sickle" region--an arc of territory stretching from China's Russian border through the arid northwest, grasslands, and mountainous areas of the southwest. The campaign was meant to reduce surplus corn output and grow more suitable crops in these environmentally fragile regions. In 2017, Henan Province withdrew corn from its agricultural insurance program--even though the province appears to be outside the "sickle" region. One agricultural technicians' commentary noted that Henan did not restore insurance for corn in 2021 even though the national corn glut turned into a deficit in 2020 and China began importing large amounts of the crop. Readers' comments observed, "Ha ha, the crop grown the most is not insured," and "Insurance is a joke."

The experts interviewed by Beijing News said the agricultural insurance needs lots of improvements. Most insurance insures only farmers' expenses for material inputs like seeds, fertilizer and pesticides, only a fraction of the crop's value. Payouts are lower for seedlings hit by disaster than for mature crops. Farmers are often dissatisfied because they were not compensated for the lost income from selling crops. China has launched new pilots to insure the full cost of production and income insurance for wheat and rice in order to address these problems.

The claims and indemnification process is long and drawn-out, with negotiations and disputes between insurance companies, local governments, and farmers. Payouts are typically made in a piecemeal fashion. Farmers who want their payouts quickly have to settle for a heavily discounted claim; they have to "wait patiently" if they want a bigger payout. Local officials often intervene in the claims process to "maintain stability." It is common for payments to be spread over the maximum number of farmers with a small average amount after a widespread disaster. A survey of farmers found that their insurance payouts tend to be about 30%-40% of their actual losses.

Chinese insurance companies devote little effort to agricultural insurance. They rarely have a full network of representatives in rural areas. Farmers have trouble contacting the company when they want to file a claim. Insurance personnel have varying qualifications, uneven training, and are often unaware of insurance policies, provisions, and procedures.

Insurance premiums are not adjusted for differences in risk across commodities, regions, and producers. Subsidies only cover premiums. One expert recommends that subsidies should also be given for operating insurance programs, for reinsurance, education, training and promotion.

The experts interviewed by Beijing News say China's agricultural insurance is still in its initial stages. They recommend clarifying indemnities, improving risk assessment, public sharing of information, incorporating environmental protection and carbon reduction in insurance products, and better coordination in administering and monitoring the program.

"The Soil That Breeds Statistical Fraud Still Exists"

Chinese officials are acknowledging that the country's statistics are riddled with fraud now that Xi Jinping has targeted statisticians in his expanding campaign to purify the Chinese communist system. Chinese statistics in the "new era" will be improved by endless audits, punishment of perpetrators, and replacement of humans with "smart" computers and gadgets when possible.

The attack on statistical fraud kicked into high gear with an August 30 speech by Xi Jinping summarizing his ideas for improving the quality of data in his "Opinions on more effective use of statistical supervision functions." That was followed by a series of articles posted on the National Bureau of Statistics web site explaining a third round of statistical inspections to root out fraud, falsification, and concealment of data.

The Bureau's director Ning Jizhe issued slogans for statisticians to contemplate: "Statistical data quality is the lifeline of statistical work." and "Truthful correct, complete and timely supply statistical data is the lifelong task of statisticians." The director explained that, "The soil that breeds statistical fraud still exists, and the struggle against unhealthy trends [continues]."

A September 2 article from the all-powerful Central Commission for Discipline and Inspection (CCDI) explained that inspections in 19 provinces over the last two years uncovered problems and improved statistical quality. CCDI warns statisticians that a new round of inspections will address local offices that drag their heels in complying with new statistical requirements, failure to punish or prevent statistical violations, and persistent inaccuracy in data. The new inspections will cover statisticians in all localities and departments.

CCDI described a web of collaborative deceit perpetrated by local statisticians, companies that report data to them, and local officials that pressure them to report flattering data. One example given was a "shocking" arrangement to inflate industrial statistics in one locality of eastern China. Local statisticians ordered companies to inflate their business income if needed so they could keep their status as an "above scale" company in a database that is tracked to monitor industry performance. Companies had to submit preliminary reports to statisticians so they could determine whether the numbers were big enough. Companies failing to meet the threshold for inclusion in the database were threatened with loss of government projects and other benefits. Companies were ordered to erase electronic chats with the statisticians to cover up the collusion.

CCDI said some local governments pressure companies to report inflated numbers "out of investment considerations," and some statisticians give companies tables with desired targets and ask them to report data that conforms to these targets. Growth rates are specified for certain months to maintain smooth growth in data. CCDI alleges that some local Economic and Information Departments held meetings to arrange the massaging of data for the year and issue "fraud subsidies" to companies. Some enterprises made false reports to meet the "regulatory" standards. Data reported to statisticians was often inconsistent with tax bureau data, CCDI said, and some did not even submit tax records.

Last week's report on the National Land Survey by the Ministry of Land Resources and Statistics Bureau demonstrated fealty to the crackdown by leading off with the the slogan of "truthfulness and accuracy as the lifeline", and a pledge to "[never] waver in the authenticity of surveys...and severely punish false reports." The survey employed "special inspectors" to scrutinize 394 local survey teams, and the process entailed hundreds of meetings and 7 rounds of "check-feedback-rectification-check again."

Frustrated by immoral and incompetent human statisticians, Chinese officials are putting their trust in machinery to collect statistics. The land survey reported extensive use of technology to minimize "the degree of human interference" in the statistical process. Data was collected with an “Internet + survey” mechanism involving remote sensing, satellite positioning, geographic information systems, mobile internet, cloud computing, and drones to reduce opportunities for statisticians to fake or screw up the data.

China's National Animal Husbandry Station (NAHS), an arm of the agriculture ministry, held a March meeting to implement a new auditing requirement for the data its network of town, prefecture, provincial and national veterinarians and technicians who count animals and meat. In July, NAHS held a training meeting where officials from national and provincial offices and six livestock and artificial intelligence companies signed a "cooperative framework agreement for joint construction of a comprehensive livestock industry information platform." Officials in the livestock information systems bureaucracy complained about "islands" in data collection, inconsistent data entry at the grass roots level, and failure of local clerks to use APPs. The new system promises a new "shared" platform with "informatized" and "smart" livestock data monitoring to open a new chapter in the modernization of animal husbandry and comprehensive revitalization of the countryside in "the new era."

CCDI blames local statisticians, officials, and companies for statistical fraud, implying that central government and party leaders are victims of misinformation. CCDI blames local officials and companies for paying too much attention to inflating indicators to achieve targets, to burnish the reputation of their city or company, or to get loans or investments. The CCDI finds no blame in the system that incentivizes the fraud by evaluating officials based on statistical achievements and success in meeting targets, distributing transfer payments and subsidies to local governments based on statistical indicators, and handing out bank loans through a state monopoly on banking based on statistical reports.

Industrial data is the most prominent example of statistical data-bloat, but the incentives extend to every area of the economy where statistical targets are handed down rung by rung in the bureaucratic ladder, including land and livestock data.

- Under Xi Jinping's rule hysteria about "food security" has prioritized targets to preserve farmland and "create" new land to "balance" land lost to development; indicators of agricultural production--including land statistics--have been included in evaluation criteria for provincial and local officials.

- Progress on a poverty-alleviation program handing out huge amounts of money is monitored with statistical surveys.

- Big money is invested in "constructing high quality cropland", fruit orchards, and rehabilitation of grasslands.

- Counties compete to get transfer payments for being major grain, oilseed and pork-supplying counties on the basis of statistical indicators.

- In 2019, officials at all levels were given targets for swine inventories and meat output to accelerate the recovery of pork supplies following the African swine fever epidemic that decimated the pig population. Hence, officials have been competing to see who can report the biggest swine numbers since last year.

It's unclear whether China's new, improved statistics will be released to the public before they have been massaged and manipulated. Xi Jiping's other priorities include doing a good job on shaping public opinion and telling China's story (not necessarily non-fiction).

China Acknowledges Tomato Price Spike to Head Off Dissatisfaction

Dozens of Chinese news reports have called attention to high tomato prices over the past month. The large number of similar reports coming o...