China keeps building more soybean processing capacity, driving its demand for soybeans ever higher and undermining Xi Jinping's dream of reducing dependence on imported soybeans.

An article issued by Shanghai-based Mysteel agricultural commodities last month reported that China's soybean crushing capacity increased from 120 million metric tons (mmt) to 140 mmt over the past 10 years.

A similar article chronicling China's soybean crushing expansion that appeared in 2022 said 10 to 15 soybean crushing facilities with 60,000 metric tons per day were planned for completion between 2022 and 2025. The ones completed have contributed to the expansion reported above. With more scheduled for completion, the Mysteel article predicts that capacity will grow further in the next 2 years.

The massive build-out of capacity--from 10 mmt in 2000 to 140 mmt now--powered China's emergence as the world's dominant soybean consumer.

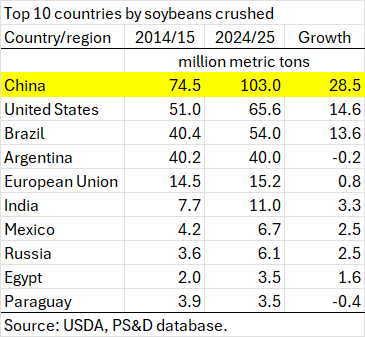

USDA's PS&D estimates show that China was already the world's biggest soybean crusher 10 years ago (in market year 2014/15). That year China consumed 74.5 million metric tons,46-percent more than the amount crushed by the United States. For 2024/25 USDA estimates China will crush 103 million metric tons, 57 percent more than the U.S. China's 28.5-million-metric-ton increase over the past decade is close to the increase in crush by the United States and Brazil combined. The combined increase in crush over 10 years by the other 7 countries in the top 10 was less than 10 mmt.

If the Mysteel capacity numbers are correct, China was using only 62 percent of its crushing capacity in 2014/15, yet crushers felt the need to add 20 mmt of new capacity over 10 years. The numbers imply that China will utilize 74 percent of its crushing capacity this year.

China has hundreds of crushing facilities built mainly at ports and rivers for cheap and easy access to imported soybeans. According to last month's Mysteel article the regional layout has been stable with 85% of capacity in coastal provinces ranging from the Bohai Gulf region in the north to the southern coast. The largest concentration of soybean crushing facilities are in the provinces of Shandong, Jiangsu, and Guangdong. Only 15% of capacity is inland, along the Yangtze River and in big pig-producing southwestern provinces of Sichuan and Yunnan.

|

| Created from data in Mysteel agricultural commodities article. |

The Mysteel article says it excludes capacity that has been idled for a long time. It appears to also exclude crushing capacity in Heilongjiang Province. The 2022 article reported that most of the Heilongjiang crushing capacity--meant for processing domestic soybeans--had been idled or switched to manufacture soy-based food products like tofu. The 2022 article implied that only 1 mmt of domestic soybeans were crushed to produce oil and soybean meal during 2021/22.

Control of China's crushing capacity is almost equally split among Chinese state-owned companies (38% of capacity), Chinese private companies (32%) and multinational companies (30%). The top companies have all been adding crushing capacity for imported soybeans aggressively, but state-owned companies (SOEs) have led the way.

The leading share of crushing capacity held by state-owned companies (SOEs) dates back to a 2008 campaign to dilute multinationals' share of soybean crushing by bankrolling SOEs COFCO and Jiusan to acquire other companies--smaller private crushers, Singapore's Noble Agri, and another SOE called Chinatex--and to build more than 10 new crushing facilities at coastal and river ports. At the end of 2021 there were 41 SOE crushing facilities, 41 private crushers, and 33 foreign-invested crushing facilities.

A posting on Baidu.com said COFCO had 20% of capacity, while SOEs Sinograin and Jiusan each had 9% of crushing capacity. Singapore-based Willmar was the largest multinational with 11% of capacity.

The bottom line is that different tentacles of the Chinese State are working at cross-purposes in the soybean sector.

Supreme leader Xi Jinping has decreed an increase in soybean self-sufficiency by ordering agricultural officials to subsidize and expand domestic soybean output and to convince feed mills to substitute alternative feeds for soybean meal.

Meanwhile, state-owned companies continue building crushing capacity for imported soybeans. And imported soybeans have been getting cheaper, keeping the facilities among the few profitable businesses in China this year. The need for an ever-increasing flow of imported soybeans to utilize the capacity, cover the fixed costs and pay debts incurred to build the facilities ultimately undermines Xi's goal of reducing reliance on imported soybeans.

No comments:

Post a Comment