Much of China's economy tipped into a contractionary phase this month due to virus outbreaks and geopolitical instability, according to the country's National Bureau of Statistics.

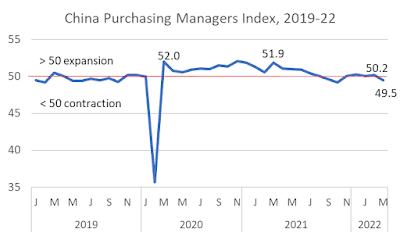

The Bureau's purchasing managers index (PMI) declined to 49.5 in March 2022, down from 50.2 the previous month. The nonmanufacturing business index fell to 48.4 (down 3.2 points)--indicating shrinking services industry activity. An index below 50 indicates business is contracting, while above 50 indicates expansion.

The March PMI indicates renewed contractionary pressure similar to numbers posted last September-October. The month's sub-50 index is a reversal of weak expansionary numbers posted from November to February. March has often been a strong month for the Chinese economy. The index hit 51.9 a year ago in March 2021. The index was 52.0 in March 2020 as the economy emerged from a February 2020 deep-freeze lock-down.

|

| Compiled from National Bureau of Statistics reports. |

One of the Bureau's senior statisticians attributed the low March 2022 PMI to clusters of virus outbreaks in many places and international geopolitical instability. The statistician said the virus had affected both supply and demand for goods, as some companies cut back or idled production. Some companies lost export orders due to recent "international geopolitical pressure." The index of new orders was 48.8.

Industries with indexes at 45 or lower included textiles, apparel, communications equipment. On the other hand, industries with indexes still above 50 included agricultural processing, food and beverage manufacturing, electrical machinery and equipment. High-tech manufacturing is still in expansion mode, although its index was down from the previous month.

Economic pressure is a force for consolidation. Large companies have a PMI of 51.3, indicating they are still expanding. However, medium-sized companies have a PMI of 48.5 (down 2.9 points) and small companies have a PMI of just 46.6.

The supplier delivery time index is 46.5, down 1.7 percentage points, indicating slower deliveries. The statistician explained that insufficient personnel on duty and poor logistics and transportation due to the virus is delaying transportation, affecting the stability of manufacturing supply chains.

The March index of nonmanufacturing business activity was 48.4, down 3.2 percentage points from the previous month. Service businesses hit hardest by the virus include those in rail and air transport, hospitality, food service and other industries where interpersonal contact is common. Consumers not only fear catching the virus--patronizing a service establishment increases their risk of being snagged in a quarantine lockdown if China's surveillance system determines they were in the same location as an infected person.

Other service industries are doing well with indexes over 60: telecommunications, broadcasting, satellite transmission services, and financial services. Construction has rebounded as warmer weather encourages resumption of building projects.