Last week's meeting of the standing committee of China's State Council called for relief policies to help beef and dairy farmers who are in financial straits. According to a report on the meeting cattle and sheep farms have seen shrinking profits due to falling prices and rising costs. The Ministry of Agriculture and Rural Affairs (MARA) has organized several meetings since August to address dairy and beef issues. An August 21 meeting concluded that the industry faces a dire situation with large losses for farmers and companies due to poor dairy and beef prices and pressure from imports.

MARA data indicate that China's beef prices have been on a downward trend over the past two years. The average September 2024 price is down 23 percent since the decline began in January 2023. The current average beef price is about the same as in 2019.

|

| Source: Wholesale price data compiled from China's Ministry of Agriculture and Rural Affairs. |

China's milk prices have been on a similar downward trend. The average Chinese wholesale milk price in September is down 24 percent since early 2023. The current milk price is lower than it was 12 years ago.

|

| Source: Wholesale price data compiled from China's Ministry of Agriculture and Rural Affairs. |

According to a September 10 commentary in Economic Daily China's livestock industry has "oversupply troubles" that result in depressed prices and difficulties for many business entities. The commentator asserted that livestock producers should be advised to slow down their expansion of livestock production capacity--by advising them to cull old low-yielding cows, for example. Yet the commentator also worried that production capacity might decline as extended financial losses put farms out of business. To avoid this, he called for the government to intervene to prevent an excessive decline in capacity.

Dairy and beef farms in China are apparently under severe financial pressure. The Economic Daily commentator and the State Council meeting both brought up shortages of working capital as key problems facing the industry. These farms rely on financing due to the fixed costs of sheds and barns, need for funds to buy feed and other inputs, and the long production cycle for beef cattle. The only concrete measures proposed in the State Council meeting were prodding banks to lend to cattle farms, accepting cattle as loan collateral, and subsidizing insurance for beef cattle. These recommendations presume that Chinese banks have plenty of money to lend, but the banks may have financial troubles of their own after the implosion of China's property sector.

Feed costs are the biggest problem, according to the Economic Daily commentator. "Not enough grass" constrains cattle and sheep farming competitiveness, as China supplies only 70% of forage needs for cattle and sheep, according to the commentator. He faults local officials for not allowing enough hay and forage crops to be planted because they "misunderstand" the demands of China's food security law which dictates that cropland should by planted in grain crops.

The Economic Daily commentator pointed to environmental protection conflicts. He thinks business entities will increase investment in manure treatment and utilization as fertilizer--again assuming they have the money to do so. He faults local officials for prohibiting livestock farming in their jurisdiction as an environmental protection measure (this seems inconsistent with his excess capacity story).

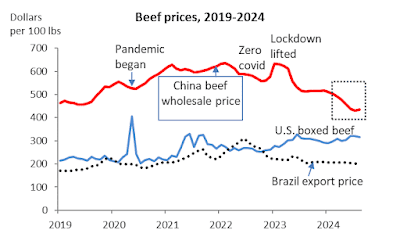

China's plummeting beef prices are out of step with international prices. U.S. beef prices have been on the rise. Brazilian prices dropped in 2022 and have been low and declining slightly during 2023-24.

|

| Sources: China Ministry of Agriculture and Rural Affairs; USDA/ERS; FAO. |

Are imports to blame for China's excess supply? China's beef imports have risen 65% since 2019 despite the onset of the pandemic in 2020, COVID decontamination and segregation requirements for meat imports, and zero covid lockdowns during 2022. Imports were stable at a record level during 2023 despite the drop in beef prices that seems to indicate shrinking demand.

Official Chinese data indicate that China's beef output has increased every year since 2016, a cumulative increase of 1.6 million metric tons (a 26% increase). USDA's PS&D dataset shows that China's imports grew 3.1 million metric tons during 2016-23--almost twice as much as the growth in China's output.

|

| Source: USDA Production, Supply & Distribution database. |

China can't blame its oversupply of beef on the Americans or Australians, though. All of the growth in beef imports has come from Brazil and other South American sources which together supply about three-fourths of China's imported beef.

China's official data also report increases in milk production every year since 2017, a cumulative increase of 38%. Imports of milk powder--China's predominant dairy import--have declined sharply since peaking in 2019. USDA's forecast for 2024 will be about half the 2019 peak volume.

|

| Source: USDA Production, Supply & Distribution database. |

No comments:

Post a Comment