China will import fewer soybeans and less corn in the next ten years, according to projections issued by China's Ministry of Agriculture and Rural Affairs (MARA) at its annual agricultural outlook conference held April 20. An examination of the track record of these projections indicates that they are a vision of what Chinese leaders would like the future to be, not an objective forecast of what will happen.

MARA expects the country's soybean imports to decline from 96.1 million metric tons (mmt) in 2021 to 85.84 mmt in 2031. This is the first time MARA has projected a decline in soybean imports since Ministry first began issuing future projections in 2014.

Although these projections are issued by a so-called "early warning committee," they have never proven to be accurate. The projections seem to reflect what Chinese leaders would like the future to look like. In particular, the projections are evidently massaged to minimize imports.

Each year from 2015 to 2021 MARA released projections predicting a tiny 10-year increase in soybean imports, and each year actual imports exceeded the projection. Then the projections were ratcheted upward the following year when it became apparent that actual imports grew faster than MARA had predicted. For example, back in 2015 MARA projected that soybean imports would rise to 80.8 mmt in 2020, but imports actually reached 100.3 mmt that year, nearly 20 mmt more than had been projected five years earlier. MARA's projected stream of imports looked like a series of parallel lines--until this year's projection.

|

| China Ministry of Agriculture projections issued at various "agricultural outlook conferences." |

At last week's outlook conference, MARA revealed its new assessment that soybean imports are on a long-term declining trend. MARA estimated that China's soybean imports will fall from 96.5 mmt to 95 mmt between 2001 and 2022, then continue declining to reach 85.8 mmt in 2031. This time MARA has ratcheted its projection of soybean consumption downward, and it predicts that use of soybeans by the crushing industry will increase by only 4 mmt between now and 2031. MARA also assumes domestic soybean output will more than double from last year's 16.4 mmt to 35.1 mmt in 2031, boosted by soybean subsidies, high prices, and a corn-soybean intercropping strategy. MARA also projected a substantial boost in China's exports of soybeans.

MARA's "early warning" committee did not warn anyone about the spike in China's corn imports during the last two years. MARA issued projections in April 2020 that predicted a small decrease in corn imports to 4.25 mmt that year, but corn imports soared to 11.3 mmt in 2020--a matter of months after the projections were issued (the projections appear to be based on calendar years). At last year's conference MARA projected an increase in corn imports to 20 mmt in 2021, but actual 2021 corn imports were 28.3 mmt.

Consistent with past form, MARA's latest projections predict that corn imports will plummet in coming years. Interestingly, corn imports will remain above the 7.2-mmt tariff rate quota until 2027. In view of MARA's history of low-balling corn import forecasts, this projection suggests that China is really short of corn.

|

| Projections made by China Ministry of Agriculture and Rural Affairs. |

This year's soybean and corn projections reflect a strong political push to reduce China's reliance on imported soybeans and corn. The campaign began in 2018 with new standards for reducing corn and soybean meal in animal feed issued as a strategy for coping with reducing supplies during the trade war with the United States. In 2021, MARA issued a more detailed document detailing alternatives to corn and soybean meal was issued, and feed companies were goaded to research new feed formulations. A deluge of documents, meetings, and news articles shows that there is strong political momentum behind the soybean campaign, in particular. This month, MARA's National Animal Husbandry Station and associations for feed, livestock, and dairy industries sent out a letter asking them to submit examples of promising substitutes for soybean meal.

Use of corn in animal feed fell from 52% in 2017 to 39% in 2021, according to an article in Economic Daily last year. The article said soybean meal use fell from 17.9% to 15.6%. China's feed industry association has begun including the percentage of corn and soybean meal in animal feed in its monthly reports. The latest report in March 2022 said corn was 36.1% of complete formulated feed and soybean meal comprised 13.1% of formulated feed and concentrate feed combined.

According to the presentation at the outlook conference, soybean prices were up 32 percent year-on-year due to factors in Brazil, Indonesia and Ukraine, discouraging consumption. The wheat presentation said a release of wheat reserves for use in animal feed and the use of "some wheat imports" for feed was motivated by high corn prices and also reduced need for soybean meal (that need was diminished by the higher protein content of wheat vs. corn.). The MARA's wheat analyst said feed use of wheat will decline 34 percent in 2022 and keep declining in the future.

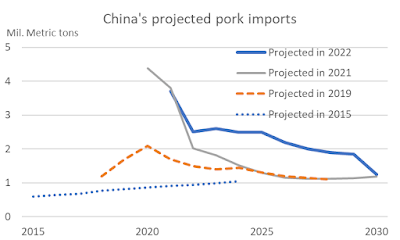

MARA also tends to underestimate pork imports. Back in 2015, MARA expected pork imports to increase gradually to 1 mmt by 2024. Pork imports hit 2.4 mmt a year later, in 2016. In 2018-19, China had a massive outbreak of African swine fever that cratered pork supplies. As pigs were dying en masse in 2019, MARA projected that pork imports could go up to 2 mmt in 2020, but imports actually shot up to 4.39 mmt. This year, MARA projects a sharp decline in 2022 pork imports--a plausible outcome in view of the decline in pork prices this year. However, MARA is projecting that pork imports will remain elevated at about 2.5 mmt annually--much higher than they have projected in past years--until 2025 when they gradually decline.

|

| Projections made by China Ministry of Agriculture and Rural Affairs. |

|

| Projections made by China Ministry of Agriculture and Rural Affairs. |

The outlook conference presentations indicated booming consumption of non-traditional animal proteins. While per-capita poultry consumption is projected to rise a modest 1 kilogram over 10 years, MARA noted that consumption of chicken is increasing while duck is decreasing and goose is steady. Chicken already accounts for two-thirds of China's poultry consumption, and "white feather" chickens are outpacing consumption of traditional "yellow feather" native breeds, the poultry presentation said. Chicken feet account for nearly half of poultry imports. MARA thinks the decline in pork prices since last year will discourage poultry consumption in 2022.

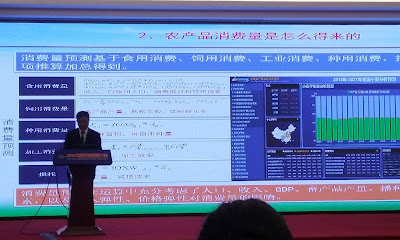

MARA's projections are always presented with complex equations, tables and charts that appear to be highly sophisticated mechanistic forecasts, but they do not appear to be much of an improvement over what could be accomplished by using a ruler and a pencil to extrapolate past trends. The projections are supposed to provide "early warnings" of food supply and demand problems, but they never show any alarming phenomena. To the contrary, the projections appear to be massaged to tell the public there is no reason to worry about the food supply. The headlines in communist party media about this year's projections emphasized that China's self-sufficiency is going to improve and the food supply is stable and reliable.

|

| A presentation of the Chinese "early warning" projection model is decorated with mathematical equations, charts and tables. |

3 comments:

Could you share a link to the source of this data?

Alternatively, could you share the most recent projection data in table format?

There are videos for each commodity that include the starting and end values at https://aocm.agri-outlook.cn/index/index/index.html

The 2020 report is posted there with tables in the back but don't see reports for other years posted.

It's all in Chinese

really like your posts. do you only focus on agriculture sector?

Post a Comment