A recent study tour of southwest China's rapeseed oil industry shows how developments in global markets filter down to the country's hinterland. The prospect of tariffs on Canadian canola has prompted companies to stockpile canola seeds and oil, while companies are relying on an expected influx of Brazilian soybeans to ease tight supplies of soybean oil. Meanwhile, demand for rapeseed meal used in fish farming has dropped as unwanted tilapia fish are piling up.

Soybeans get the most attention, but rapeseed is the second-largest segment of China's edible oil supply. Unlike soybean oil (derived almost entirely from imported beans), rapeseed oil is produced from three sources: crushing domestic seeds, crushing imported seeds, and refining imported rapeseed oil.

|

| Estimated from Ministry of Agriculture, China Agricultural Supply & Demand Estimates (CASDE) and USDA's PS&D database. |

China imports all of its palm oil. The country produces peanut and cottonseed oils from homegrown crops. China also imports sunflower and sesame oils while also processing homegrown sunflower and sesame seeds.

The rapeseed supply's reliance on imports is a food security concern for Chinese officials. Rapeseed--including the Canadian variety canola--is also a political cudgel used in relations with Canada.

In September 2024 China announced an antidumping investigation of canola seed imported from Canada. This announcement was both a retaliation against Canada's 100-percent tariff on Chinese electric vehicles and a measure intended to slow down a surge of imports that hit China during the 2024 harvest season. Two months ago in March 2025, China announced 100-percent tariffs on Canadian canola oil and meal.

A group of Chinese futures market analysts recently toured rapeseed oil processing and trading companies in Sichuan Province and Chongqing Municipality in southwestern China. The study tour found that local processors and traders deep in China's interior are tied into the world market through shipments of rapeseed and rapeseed oil arriving by rail and truck from ports in southern China, by barge on the Yangtze River from eastern regions, and on the China-Europe express railway that crosses from Russia into western China.

No antidumping tariffs on canola have yet been announced, but the Sichuan-Chongqing study tour learned that Chinese importers have been stockpiling imported canola and oil in anticipation of higher tariffs. Sichuan and Chongqing companies are also watching global developments such as impacts of Indonesian weather and Malaysian replanting on palm oil production and prices, delays in customs clearance of soybeans imported from the U.S., the size of the Brazilian soybean crop, relaxation of Argentina’s foreign exchange controls, and U.S. biodiesel policy.

This region traditionally relied on local rapeseed for the chili-infused oil that forms the base of local hotpot and other fried cuisine. Rapeseed oil is still more prevalent in Sichuan and Chongqing than in other regions, but soybean oil has made inroads. Varying estimates suggested that soybean oil's use in Sichuan, Chongqing and other southwestern provinces is equal to or slightly larger than rapeseed's use. Cottonseed oil is also shipped to Chongqing from Xinjiang, China's main cotton region.

One processor in Sichuan observed a clear declining trend in local consumption of oils over the past 2 years, likely reflecting the poor state of China's economy. Another indication of hard times for consumers is the 20-to-30 percent drop demand for premium-priced specialty oils estimated by one interlocutor. A food trader commented that restaurant and food processing business is slack, and household consumption of oil has not changed much.

The region has 9 edible oil processing facilities with excess capacity. One company said it uses only 1 or 2 of its 8 production lines. Large companies are gradually crowding out small competitors.

Sales of rapeseed oil in the region are split between sales for home use in shops and supermarkets (30%), restaurants (40%), and food processors (30%). The team heard that large processors and restaurant chains tend to substitute soybean and cottonseed oils for rapeseed oil when price spreads widen, but small restaurants and consumers are less price sensitive. One food trader told the study team that it is a false proposition that Sichuan cuisine must use rapeseed oil.

In interviews with futures analysts, companies indicated the low cost of soybean oil is the main driver of its popularity. A trader told the futures analysts that the low price of soybean oil has driven its substitution for rapeseed oil in Chongqing. Recent data shows rapeseed oil is currently the most expensive of 3 major vegetable oils in China. A surge in price during March 2025 coincided with the announcement of 100% tariffs on Canadian oil and meal. Soybean oil is currently the cheapest oil, even cheaper than palm oil which traditionally has been the cheapest. This year palm oil's price has declined from an unusually high level last year.

|

| Wholesale prices reported by China State Administration of Food and Commodity Reserves in Jiangsu for soybean and rapeseed oil, Guangdong for palm oil. |

Despite the relatively low price of soybean oil, companies mentioned that supplies of soybean oil are tight. A Chongqing company attributed the tight supplies to strict inspections and lengthy customs clearance times meant to keep out North American soybeans. They agreed with other assessments that soybean supplies may rebound when supplies of Brazilian beans increase later in May. One person interviewed predicted that soybean meal supplies could rebound if China-U.S. negotiations are successful in June.

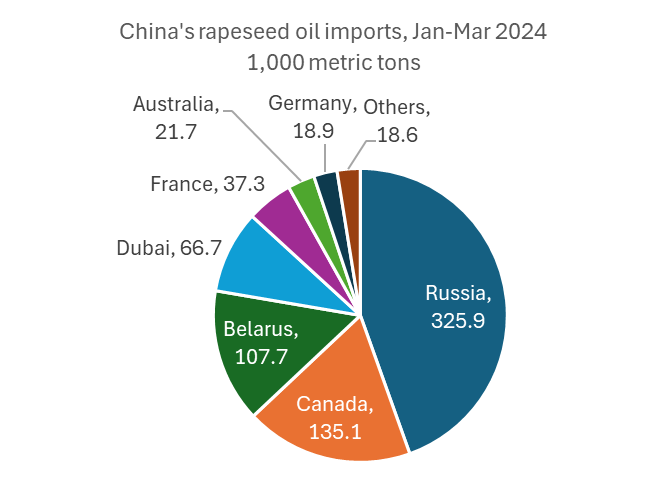

China has imported 732,000 metric tons of rapeseed oil in the first 3 months of 2025. Nearly half of the imports came from Russia, but companies complained about difficulties settling transactions--probably due to sanctions--that require use of a Chinese intermediary in the transactions. During calendar year 2024 imports from Russia topped 1 million metric tons. More than half of Russian rapeseed oil arrives on the China-Europe express rail line. One processing plant complained about the uncertainty of Russian rapeseed oil supplies. Imports of canola oil from Canada surged in the first 3 months of the year as companies appeared to be rushing to beat tariffs.

|

| Data from China Administration of Customs. |

China has imported 900,000 metric tons of rapeseed in the first 3 months of 2025, of which 842,000 metric tons of canola came from Canada. Canola seed imports from Canada surged to over 6 million metric tons in calendar year 2024, prompting the antidumping announcement. Imports of rapeseed from Russia are much smaller. One processor in Sichuan noted that Russia requires that rapeseed be processed in Russia. Another noted that Russian rapeseed meal has excessive fiber. Rapeseed meal from India contains toxins that make it unsuitable for aquaculture.

One feed mill said it had reduced rapeseed inclusion in its formula after announcement of the 100% tariff on Candian rapeseed meal. Local rapeseed meal availability increases after the local rapeseed harvest which is late this year due to weather issues. Cottonseed meal, rapeseed cakes, and DDGS were identified as substitutes for rapeseed meal. Environmental regulations are cutting back aquaculture production in China.

Soybean meal has been in tight supply since April 2025. Inventories are 3-to-5 days, down from a customary 10 days.

Companies interviewed on the study tour mentioned that U.S. tariffs have cut China's export sales of pond-raised tilapia fish--many of which are produced for the U.S. market. This also drove down the price of grass carp. Declining fish production has reduced demand for rapeseed meal, cutting into profits from rapeseed crushing.

No comments:

Post a Comment