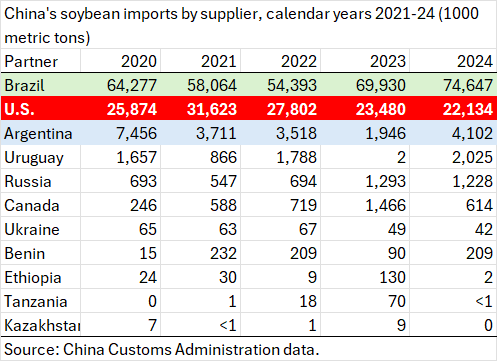

For decades Chinese leaders have been clamoring to "diversify" imports of agricultural products to reduce reliance on the United States. Having experienced the trade war with China 7 years ago, U.S. commodity producers have also declared their eagerness to diversify their export markets. Both diversifications are tough going because Brazil is the only real alternative supplier with capacity to supply China's gargantuan import needs. Likewise, alternative markets are not large enough to absorb the volume of U.S. soybeans sold to China.

China has been importing enormous quantities of Brazilian soybeans. In calendar year 2024 China boosted its imports of Brazilian soybeans to nearly 75 mmt--over 70% of the total. China imported only 22 million metric tons (mmt) of soybeans from the U.S. last year, but it's hard to see how those beans could be replaced. No other country shows signs of sustained growth as a soybean supplier to China. Imports from Argentina have been up and down. Imports from Uruguay hit 2 mmt in 2024 for the first time. Imports from Russia during 2023 and 2024 jumped to over 1.2 mmt after a Russia-China grain trade deal was signed in 2023, still a long way from replacing U.S. supplies. China is trying to nurture soybean suppliers in Africa, but their supplies are small and inconsistent.

|

| U.S. export data from USDA Global Agricultural Trade System. |

The U.S. sells soybeans to more than 90 countries, but prospects for replacing sales to China are bleak. Sales to Mexico, the EU, other East Asian countries and Egypt have been in decline since 2020 as the U.S. also faces stiff competition from Brazil in some of these markets.

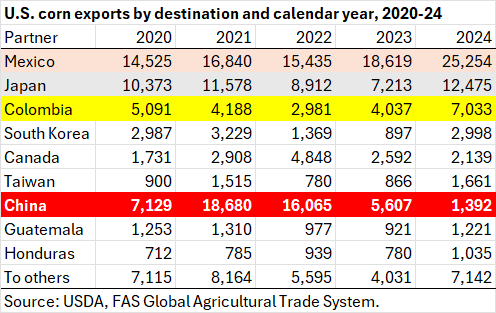

China and the U.S. are less intertwined in corn trade. In 2024 China had 3 chief suppliers of corn imports. China acted in 2012 to dilute its reliance on U.S. as a corn supplier by opening its market to Ukrainian corn and beginning negotiations with Brazil. Ukraine was the top supplier of China's imported corn in 2020. China's imports from Ukraine dropped off slightly in 2022-24 following Russia's invasion of Ukraine. Meanwhile, imports from the U.S. surged in 2021 and 2022. Then, details of a China-Brazil corn import protocol were finally worked out and Brazil suddenly became China's top corn supplier in 2023 and 2024. Imports from other countries like Myanmar, Bulgaria, and Laos have been relatively small and inconsistent from year to year. Despite the 2023 grain trade deal with Russia, China's imports of Russian corn are underwhelming. Starting in mid-2024 China dialed back corn imports from all sources to insulate its farmers from declining corn prices. Corn imports remained unusually low during the first months of 2025.

The United States never relied much on China as a corn export market until a surge in sales made China the top foreign market for U.S. corn during 2021-22. That surge was an anomaly attributed to a perfect storm of factors: China's Phase One commitment to buy U.S. products, a 40-percent increase in Chinese corn prices during 2020-21, China's rebuilding of corn stocks following a disgorgement of excess reserves completed in 2019, and a massive rebuilding of its swine herd after a 2018-19 African swine fever epidemic. In historical context the drop in U.S. corn sales to China during 2022-2024 looks like a return to business as usual. U.S. exports of corn to Mexico, Japan, and Colombia boomed in 2024 as sales to China declined.

|

| U.S. export data from USDA Global Agricultural Trade System. |

These are just two of the many commodities traded between the U.S. and China. Despite China's bluster about diversifying its import sources, Brazil is the only other country with the resources and productivity to meet China's enormous needs for farm commodities. Brazil is also a top supplier of China's beef, poultry, sugar, and cotton. China's "diversification" actually entails creation of a huge dependence on Brazil.

No comments:

Post a Comment