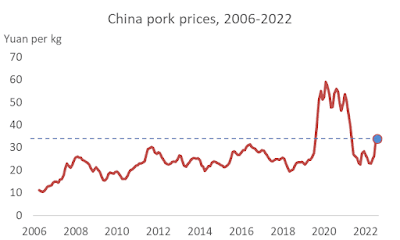

Chinese officials thought they could stabilize the pork industry by replacing small farmers with corporate behemoths. China cut the number of pig farming operations in half over 5 years. Of the 21 million producers that remain, China's top 4 companies produced about 78 million hogs last year, about 12 percent of the country's total. But the industry is as unstable as ever.

|

| Data from Ministry of Agriculture price reports. |

|

| Compiled from China livestock industry yearbooks and 1996 agricultural census. |

China's number-2 pig producer, Jiangxi Zhengbang Technology Co., attracted attention in July with

reports that some of its pigs were starving due to disrupted feed deliveries. There were reports that farmers producing hogs for Zhengbang in multiple provinces were not getting feed supplies, farmers were not getting paid, and employees complained of unpaid wages.

This summer, Zhengbang's monthly hog sales volume shrank to less than half the pace of a year ago. Another indicator of trouble is sales of immature hogs averaging 75 to 87 kilograms per head during April-June, well below the typical weight of 110 to 120 kg and much less than 140-kg slaughter weights a year ago.

Commentators attributed the feed disruptions and missed payments to Zhengbang's dwindling cash reserves following steep losses in 2021 that exceeded all the profits the company had made in previous years. Zhengbang officials said it was a temporary blip due to restructuring. One commentator surmised that the company's sale of its feed mills--a desperate move to raise cash--may have been part of the problem.

Zhengbang's financial woes can be traced to a debt-fueled race over the last four years to gain market share in an industry long dominated by small-scale farmers. Chinese officials had long blamed back yard farmers for "blind" expansion and sow culls that produced gyrations in production and prices. Officials longed for an industry dominated by big companies that would stabilize the market.

Officials recruited companies to lead the recovery from the "blue ear disease" pork shortage in 2007, but the companies never made much headway competing with nimble, low-cost backyard farmers. An environmental clean-up following the 10,000 dead pigs floating through Shanghai in 2013 was another opportunity. Officials shut down millions of pig farms, giving pig-farming companies a new opening for expansion to fill the vacuum. However, many of the companies were in financial trouble by 2018. One prominent player, Chuying Pastoral, also had a much-publicized starvation of pigs and tried to repay creditors with hams before going under that year.

The African swine fever (ASF) outbreak in 2018-19 provided the biggest opportunity yet. Individual farmers slaughtered entire herds, often received no compensation for culling herds, feared resurgence of the disease, and had no funds to ramp up operations after their cash chain was broken. Moreover, a raft of policies, including earmarked loans, land-use approvals, expedited environmental assessments, and subsidized equipment for new and expanded pig farms mostly favored large-scale companies.

Zhengbang took advantage of China's ASF epidemic to vault to a top position in the industry. In 2017 most of Zhengbang's income came from feed sales, though it also sold 3.4 million swine. In 2019--a year of national pork shortages and record-high prices--Zhengbang's swine sales jumped to over 5 million head. By 2021, Zhengbang sold 14.9 million head, leapfrogging New Hope Group and Wens Foodstuff to become the number-2 pig-producer in China.

While 20 million small pig farms were disappearing over the past 5 years big companies were in a race to expand. Between 2018 and 2021, China's top 10 pig-farming companies doubled their combined share of industry output from under 7 percent to 14 percent. Moreover, the head of New Hope Group complained in 2020 that 1,000 real estate companies had also started raising hogs. According to statistics, national pork output had recovered to near its pre-ASF level by the end of 2020 but pork demand was crimped by China's weak economy, covid lockdowns and curbs on travel. In 2021, hog prices plummeted more than 50 percent. Costs rose due to rising feed prices, bidding wars for scarce piglets, sows, and personnel, big spending on new facilities, and low feed conversions on hogs raised to absurdly large weights. Conditions worsened in the first half of 2022 with a new round of covid lockdowns, consumption in the doldrums, and soaring feed prices due to the war in Ukraine.

Zhengbang posted a loss of 19 billion yuan (about $2.9 billion) in 2021 and 3-to-4 billion yuan in the first half of 2022. After borrowing heavily to finance both working capital and new construction, Zhengbang's debt was officially reported to be 97 percent of its assets and some analysts think the debt-asset ratio is now over 100%. Its stock price rose as high as 28 yuan in 2020 but is now down to 5.7 yuan. Its share price has fallen 25 percent over the past month.

Last week, one commentator speculated that Zhengbang could be on the same path to oblivion Chuying Pastoral followed four years earlier. The commentator thought the decline of both Chuying and Zhengbang was due to "blind expansion" during a time of high prices--exactly the behavior Chinese officials have long moaned about as a defect of small-scale farmers.

In May 2022 Chinese hog prices began rising again. Market commentators attribute the new price rise to a revival of demand as covid lockdowns were lifted and producers holding their hogs longer, hoping for even better prices. The price increase restored profitability but made government officials nervous about food price inflation. China's hog market seems as unstable as ever.

Xi Jinping's rural strategy envisions big companies like Zhengbang leading small-holding farmers into a magical era of common prosperity. Xi's signature poverty alleviation campaign ordered pig companies to ramp up "company + farmer" pig-raising operations in poor regions with a dual objective of raising rural incomes and restoring pork supplies asap after the African swine fever epidemic. Zhengbang's recent experience shows that this mechanism works when prices are rising, but the whole thing can seize up when prices fall.

Like most pig companies, Zhengbang contracts with individual farmers to fatten some of their hogs (about 40% of Zhengbang's 2021 production, based on estimates by Shanghai financial news outlet Cai Lianshe). Contracts call for Zhengbang to supply the piglets, feed, drugs and vaccines, while the contracting farmer provides the labor and facilities for a set fee per pig. Commentators say this "asset-light" strategy allows companies to expand rapidly without having to invest in giant farms. They earn lots of money when prices are high, but they can lose a lot when prices fall.

Disputes over farm contracts in China are common when prices rise and when they fall. If prices during the contract period farmers are tempted to sell animals on the open market when prices are high. When prices fall companies mired in losses often miss payments or accuse farmers of delivering substandard products.

Contracting farmers were in a bind when Zhengbang stopped delivering feed. Zhengbang technically owned the pigs, so if farmers went out and bought their own feed they would be making a loan to Zhengbang that would likely never be repaid. Farmers couldn't just walk away from their contracts because they had paid deposits to the company. Some farmers said Zhengbang came and collected their pigs with no explanation. Some farmers trying to get money from the company camped out in the company's courtyard or threatened to commit suicide. One farmer said it is possible to take legal action against the company and win, but it's a lot of trouble and you probably won't get any money.

A Zhengbang financial manager told Shanghai's Cai Lianshe that the company is cutting back on contracts with individual farmers to raise pigs, citing unsatisfactory disease prevention, high mortality, and lower costs when the company raises its own hogs. Zhengbang had contracts with 7,951 farmers in 2020, but the number was cut back to 5,743 in mid-2021.

Two commentaries on Zhengbang's "starving pigs" incident both seem to endorse the fully integrated production model used by Muyuan Foods, the biggest pig producer in China and the world. Muyuan produces its own pigs and raises them to slaughter weight on its own giant factory-style farms.