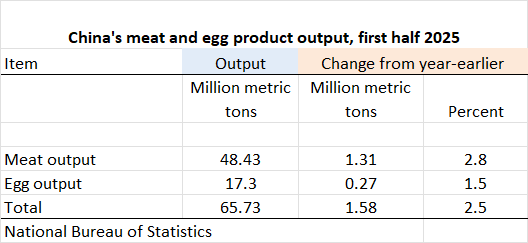

In the first half of 2025 China increased its meat and egg production by a combined 1.58 million metric tons (mmt) from a year earlier, a moderate increase of 2.5%. Meanwhile, animal feed output during H1 2025 compiled from feed industry association reports increased by 14.5 mmt (+10 percent) from a year ago. China's 14.5-mmt increase feed output growth outpaced the 1.58-mmt growth in meat production by a ratio of 9:1. It's hard to make sense of these inconsistent figures.

According to China's feed industry association reports, corn accounted for about 43 percent of feed ingredients and soybean meal accounted for about 13 percent in H1 2025. The association gives no clue about what makes up the other 40-plus percent of feed ingredients. There could be more wheat used in feed this year since corn and wheat prices are near parity, but it's hard to imagine what other ingredients could be fueling such a big increase in feed output.

Consumer demand in China is not strong. Imports of meat and seafood were down slightly in H1 2025. Calculations suggest China's H1 2025 meat supply was 51.6 mmt (the sum of domestic output and imports), up 1.2 mmt (2.4 percent) year-over-year, due entirely to the expansion of domestic meat output. An earlier post noted declining prices of meat and eggs in 2025, implying that supply outpaced consumption.

Imports of rapeseed meal increased 1.1 mmt yoy, slightly more than the yoy increase in soybean imports. No other protein meal or processing byproduct showed a significant growth in imports in H1 2025.

|

| Calculations using data from China Feed Industry Association reports. Data are missing for months when no report was issued. |

Calculations indicate soybean meal used in feed production has been equal to or higher than in recent years, based on the feed industry association data. Soybean meal use was at a high level in January-February 2025, and June use was slightly higher than in June last year.

|

| Calculations using data from China Feed Industry Association reports. Data are missing for months when no report was issued. |

Prices do not indicate especially tight markets for feed ingredients. Rising Chinese corn prices during H1 2025 indicate growth in corn demand. This month's corn price is about equal to last year's price, but those prices were more than 15 percent lower than prices in 2022 and 2023. Soybean meal prices have fallen to the lowest level in several years this month after record imports of soybeans from Brazil arrived in May and June and revved up the soybean crushing plants.

|

| China National Bureau of Statistics, raw material prices paid by companies. |

|

| China National Bureau of Statistics, raw material prices paid by companies. |

The only thing we can safely conclude is that the production data from the National Bureau of Statistics and feed output data from the Feed Industry Association are inconsistent with one another. Both data series may be dodgy, but the feed data appear to be especially suspect. The slow economy and soft prices for both consumer foods and farm goods suggests demand is not especially robust. Demand for imported soybeans appears to be solid and on a path to match last market-year's total. The surge of soybean imports from Brazil since May and June coincides with a rebound in the use of soybean meal in feed to 13.7% in June. The expanded use of corn in feed is consistent with reports of a big harvest last fall. China seems to be managing OK despite paring back imports of feed grains.

No comments:

Post a Comment