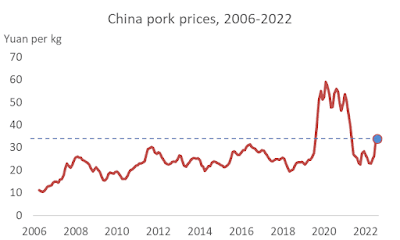

China's August 2022 CPI report said pork prices were up 22 percent from a year earlier, the largest increase of any component of the price index. The Statistics Bureau reckoned that the 10-percent increase for the broader meat category contributed 0.32 percentage points to the 2.5 percent year-on-year rise in consumer prices.

A year ago, the August 2021 CPI report said pork prices were down 44.9 percent from a year earlier, the largest decline of any component of consumer prices. In August last year, the meat component of the CPI pulled down the 0.9-percent CPI change by 1.2 percentage points.

According to agriculture ministry wholesale market price monitoring, August 2022 pork prices averaged 33.88 yuan per kg (about $2.23 per lb). That was higher than any historical pork price excluding the once-in-a-lifetime prices during Sept 2019 to January 2021 when African swine fever cratered pork supplies.

|

| Data from China Ministry of Agriculture and Rural Affairs market monitoring. |

Chinese officials have been spooked by the gyrations in pork prices. In a July macroeconomic analysis by the State Council's Development Research Center think tank, three economists investigated the lurking risk of a new rapid surge in pork prices. They zoomed in on the possibility that "excessive shedding of production capacity" due to rising feed costs, a broken financing chain for some large-scale hog producers (e.g. Zhengbang), and over-zealous environmental regulators shutting down pig farms.

The economists said another price spike was unlikely because big farms that can withstand cyclical pressures are squeezing out small independent farms. They were pleased to report that

- scaled-up farms producing 500 head or more had increased their share from 53% to 60% between 2019 and 2021.

- Sows held by scaled farms increased by 4.4% between April 2021 and June 2022 while sows held by small independent farmers had fallen 11.6%.

- High-productivity second-generation sows increased from 50% of the herd in May 2021 to 88 percent in February 2022 as low-productivity third-generation sows have been displaced.

- While 21 publicly listed hog companies produced 15% of hogs last year, 14 of them reported losses totaling 53.97 billion yuan

- 20 companies posted losses in the first quarter of 2022 totaling 18.94 billion yuan

- 14 companies have debt-asset ratios over 60%, and four have ratios over 80%.

- The report singled out Zhengbang Sci-Tech, the no. 2 pig producer, for its particularly dire financial straits.

No comments:

Post a Comment