According to feed industry association statistics based on regular reporting by companies, China produced 191 million metric tons of manufactured animal feed during 2013. China's feed industry surpassed the United States a couple years ago to become the largest in the world. But after growing at rates of 7-to-12 percent during 2010-12, China's feed industry output fell 1.8 percent during 2013.

The industry was affected by a number of factors that hit China's meat industry during 2013. Demand for meat was slowed by the general slowing of the economy. Moreover, communist party authorities issued "eight regulations" which ordered officials to dial back their banqueting, putting a crimp on meat demand since banquets always include numerous meat dishes. Without the artificially inflated demand created by banqueting in past years, there seems to be slack in demand.

Poultry was hit by two incidents. In late 2012, an expose on China's Central Television revealed that chicken suppliers routinely flouted regulations on feeding pharmaceuticals to their chickens. In March 2013, the H7N9 avian influenza epidemic shut down many poultry markets and reduced poultry consumption. Poultry processors were seriously affected and had to put large amounts of meat in storage. Farmers and breeders reduced their chicken flocks.

The pork industry had excess capacity and downward pressure on prices early in 2013. Publicity from pig carcasses found floating in Shanghai's Huangpu River further depressed pork consumption.

Packets of amino acids to be mixed with feeds by farmers at a shop in Chongqing.

The composition of feed products changed, reflecting the flexibility of livestock producers adjusting to the depressed market. During the down period, livestock producers have reverted to mixing their own feed on-farm with cheaper local materials instead of buying ready-made compound feeds. The hottest feed products were premixes and additives which grew 1.7%. Production of compound feeds declined 1.2 percent, a reversal of rapid growth in this type of feed in the last few years. The increase in pre-mixes reflects the surge in on-farm feed-mixing. These products--which contain vitamins, amino acids, trace elements and other nutrients--are mixed on-farm with other feed stuffs. Similarly, large-scale commercial farms also shifted toward more on-farm mixing of feed instead of purchasing ready-made formulated feed. Compound feed is still the predominant product, with output at 161.7 mmt, compared with 6.3 mmt of premixes and additives.

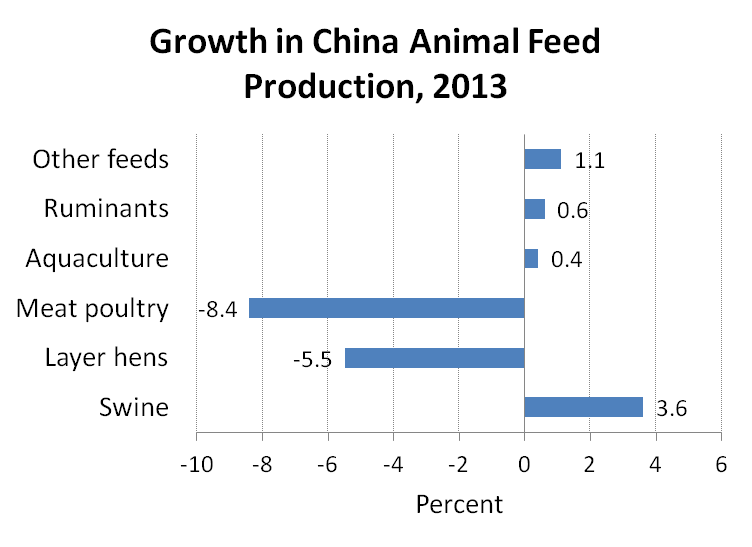

Poultry feed took the biggest hit during 2013. Feed for meat poultry was down 8.4 percent and feed for layer hens was down 5.5 percent. Poultry has a disproportionate impact on the feed industry. These two types of poultry accounted for over 40 percent of China's feed output in 2013, about equal to the share of feed produced for swine. In comparison, pork accounts for about two-thirds of China's meat output. Pig feed production went up 3.6 percent in 2013, but that was slower than in previous years.

Source: Dimsums, using data from China Feed Industry Association.

Similarly, provinces that produce a lot of poultry feed were the hardest hit. During the first three quarters of 2013, Shandong's feed output fell 15.1%, neighboring Hebei's production was down 6.1%, Guangdong's fell 3.2% and Henan's fell 4.1%. Feed production was stable or grew in central and western provinces. Growth in feed output was 4.3% in southwest provinces and 3% in central and northeastern provinces.

Chinese feed companies are facing broad cost pressures from rising labor costs, energy, and expenses like marketing fees, financing costs, and management costs. Corn costs had been rising from 2010 to 2012, but prices fell slightly during 2013. China's corn prices are still at a high level, however. Companies face environmental constraints and difficulty gaining access to land. With the adoption of international standards, business costs are rising.

The article describes Chinese feed companies as taking the opportunity of the crisis to make strategic adjustments in what is described as a key period in the industry's transformation. Some are using the down period to retool and acquire new equipment. Large companies are getting bigger and some small companies are merging together. Weak companies are vulnerable to bankruptcy or takeover. Some feed companies are forward-integrating into livestock production. Many of the larger companies "no longer think of themselves as feed companies." With costs rising and margins slim, feed companies are diversifying to find profits.

For example, in September 2013 a feed company called Dabeinong announced a 7-year plan to jointly operate a network of giant farms supplying hybrid sows to farmers. They are concentrating on sows because they bring a profit of several thousand yuan while the hog-fattening business earns only 200-yuan per head. They plan to invest 1 billion yuan with a goal of producing 6 million hogs annually with slaughter capacity of 4 million head. The investments of the company, Heilongjiang's provincial government and farmers are expected to total 10 billion yuan.

A commentary on the future of the feed industry urged companies to rethink how they do business by automating operations, focusing on e-commerce, and offering financial, data, information, and Internet services.

The upgrading and consolidation is driven by competitive pressures and encouragement from the government. A series of food safety incidents have undermined consumer confidence in meat products. Addressing animal disease concerns are another priority. The government is pushing integration, concentration, and larger scale in the feed and livestock industries. In October last year, a plan for beef and mutton industry development called on each locality to develop a big flagship company. Draft State Council regulations for controlling livestock pollution emissions also call for increasing the scale and standardization of livestock farms. Also, last year companies had to renew their production licenses, requiring upgrades to stay in business.

2014 was supposed to be a year of recovery for the feed industry, but it got off to a bad start. Hog farms are losing money, another outbreak of avian influenza is keeping the poultry industry depressed, and the government is supporting corn prices at an artificially high level.

1 comment:

Radha Raman is one of the best Trusted Animal Feed Manufacturer in India

Post a Comment