Tariffs on U.S. imports are impacting prices for certain types of meat and animal feed.

Reports posted on China's Feed Industry Information net note that supplies of soybeans and soybean meal are tight. The latest customs data show soybean imports for March 2025 were only 3.5 million metric tons (down 7.9 percent from a year earlier), said to be the lowest monthly volume in years. Buyers have already cut back sharply on purchases of U.S. soybeans while deliveries of Brazilian soybeans have been delayed by slow Chinese customs inspections. Soybean crush volume fell to 980,000 metric tons last week.

The decline in soybeans processed constricts the supply of soybean meal available for use in animal feed. Soybean meal prices in northern China are reported on April 14 to be in the range of RMB 3,680-to-3,730 per metric ton, up RMB 200-to-230. The price in Guangdong previously quoted at RMB 3000-to-3040 per metric ton also rose RMB 200 as many northern buyers made purchases in Guangdong over the weekend.

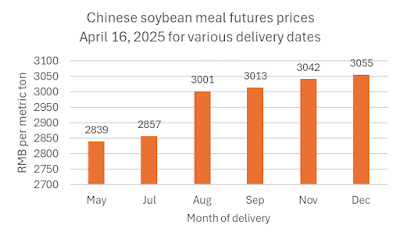

Futures prices for Chinese soybean meal have been fluctuating in a range of RMB 2,800-to-3000 per metric tons since February while U.S. soybean meal prices have fallen. Chinese soymeal futures prices for May delivery climbed last week as the tariff war heated up, hitting their latest peak at RMB 2958 on April 14, before declining to RMB 2839 today.

Another Feed Industry Information Net article showed announcements of increases in prices for piglet feed and feed concentrate of RMB 100 per metric ton released by several companies. Price increases are driven by rising prices of soybean meal and concentrated milk powder (probably referring to whey which is imported from the U.S. in large volumes).

The article noted rebounds in prices for broiler meat as supplies are tight following peak sales during the Chinese New Year holiday which reduced the number of chickens being marketed now. The article showed that price increases have been largest for chicken feet and wings due to the escalation of tariffs. The price of cooked chicken feet imported from the U.S. reportedly increased RMB 200-to-500 per metric ton on Monday.

China imports beef from a number of countries besides the U.S., but beef prices are also rising. The article reports that prices of imported South American beef have been skyrocketing. The price of Marfrig beef traded on a Chinese exchange rose RMB 1,500 per ton in a single day and JBS beef rose RMB 1,200.

Domestic Chinese beef prices are also on the rebound. According to the feed industry article ban unusual decline in beef prices during 2024 attributed to an influx of imported frozen beef has been reversed in 2025. The Ministry of Agriculture and Rural Affairs has reported a 15.8-percent increase in wholesale beef prices since March--coinciding with the heating up of the tariff war. The price is up 4.6 percent from a year earlier. Beef price increases are concentrated in northern regions of China. Traders have been buying up cattle from southwestern regions where prices have remained low and transporting them to the north.

No comments:

Post a Comment