China's agricultural GDP grew 3.5 percent from a year earlier in the first quarter of 2025, slower than the 5.4 percent growth in overall GDP according to the latest figures from China's National Bureau of Statistics. Income earned by rural businesses (predominantly farms) grew 4.7 percent. These numbers seem inflated since physical output of farm goods grew at less than the GDP growth rate and farm prices were down. Livestock output was up moderately from a year ago while prices crashed, indicating weak demand.

The impact of consumer subsidies on the economy was narrowly focused on electronic gadgets. Production of electronic vehicles boomed, but industrial prices were down, consumer prices were mostly flat, China's exports were up and imports were down.

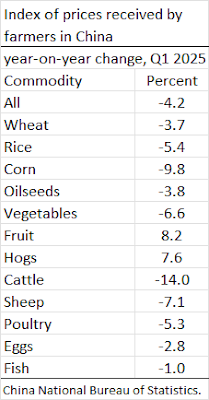

Farm prices in China were down 4.2 percent from a year earlier, according to the index of prices received by agricultural producers. A sharp drop in the price of corn--the largest component of animal feed--is consistent with tepid demand for meat, milk and eggs. Corn prices were down 9.8 percent, rice prices were down 5.4 percent, cattle prices were down 14 percent. Hogs and fruit were the only farm commodities with price increases.

The year-on-year increase in hog prices is misleading. Hog prices reported by the Ministry of Agriculture and Rural Affairs have fallen 28 percent from their peak level in August 2024. April 2025 hog prices are about the same as April of last year. Pork prices followed a similar path.

|

| Wholesale prices reported by China's Ministry of Agriculture and Rural Affairs. |

China's overall CPI was down 0.1 percent from a year ago, while the food, alcohol and tobacco component was down 0.7 percent. The price index for food manufacturers was down 1.5 percent year on year.

Not many crops are harvested in the first quarter, so livestock constituted the main component of agricultural output. The number of hogs slaughtered in Q1 was nearly the same as a year earlier, while pork output was up 1.2 percent, implying higher slaughter weights. Beef output (up 2.7 percent) also grew faster than the number of cattle slaughtered (up 1.3 percent). Milk output was up 1.7 percent. Poultry meat output was up 5.1 percent, the only livestock item that exceeded the 3.5 percent growth in agricultural GDP. Production of eggs was down slightly, and mutton output fell 5.1 percent from a year earlier. The inventory of swine was up 2.2 percent from last year, the number of poultry was almost the same, and the number of cattle was down 3.5 percent.

China continued its export-manufacturing driven pattern of growth. Manufacturing output by "above-scale" enterprises was up 7.1 percent year on year. Growth for high-tech manufacturing was 9.7 percent. Production of new energy vehicles and 3-D printing equipment were up 45% and industrial robots were up 26 percent.Ex-factory producer prices, meanwhile, fell 2.3 percent, and raw material prices fell by the same amount.

China's property sector remained in free fall. Investment in real estate plummeted 9.9 percent from a year ago, and that followed a 9.5-percent year-over-year decline in Q1 last year. The square footage of completed commercial real estate was down 3 percent from a year ago, slower than the 19-percent year-over-year plunge reported in Q1 2024.

Per-capita consumer expenditures were up 5.3 percent. The Statistics Bureau said consumer subsidies for cell phones, tablets and smart watches helped boost consumer expenditure on the communications category by 11 percent from last year.

China's Q1 2025 exports were up 6.9 percent and imports were down 6 percent from a year earlier.

The Bureau claims that rural households' per capita disposable income grew 6.2 percent (6.5 percent after accounting for the slight decrease in consumer prices) in Q1. They reported that rural households' income from wages and salaries increased 6.7 percent. Rural business income went up 4.7 percent.

The Bureau also reported that average monthly income of rural migrants had grown only 3.3 percent--half the growth rate of income from wages and salaries. The monthly earnings of rural migrants averaged RMB 5,012, which works out to about US$3.40 per hour at the current exchange rate with an average 48-hour work week.

The number of rural people with nonfarm employment was 187.95 million, up 1.1 percent from a year earlier. The Bureau reported that rural migrants had an unemployment rate of 5 percent, about the same as a year ago. The national average unemployment rate was 5.3 percent.

No comments:

Post a Comment