China's liberal policy for soybean imports is conveying benefits to Chinese consumers. Falling global prices for soybeans are causing China's cooking oil prices to drop.

Yihai Kerry--a Singapore-owned company that is the leader in China's cooking oil industry--announced that it plans to cut prices on its Arawana-brand vegetable oil products by 10%. This follows similar price cuts over the course of last year that will bring vegetable oil prices down more than 20% from early 2013. A company spokesman attributed the price cut to a decline in the cost of raw materials that is due to falling global prices for soybeans since last year.

Competition ensures that low prices are transmitted to consumers. The second-biggest veg oil-supplier, COFCO, said it also plans to cut the price of its Fulinmen oils about 10%.

Yihai Kerry has sent out a letter to sales agents notifying them of the price cut. It will take four to six weeks for the price cuts to reach retail products.

A reporter checked price quotations from a wholesale market in Beijing and found that a case of four 5-liter bottles of Arawana soybean oil cost 204 yuan in January 2013. The price was down to 173 yuan in December 2013, a decrease of 15%.

In general, Chinese food prices seem to be in deflationary mode. According to National Bureau of Statistics retail food price data for mid-March, sixteen commodities fell in price and eight increased. Several were unchanged. Pork prices fell 2.4% during the first half of March 2014.

In contrast, Chinese officials are preventing corn prices from falling by buying up 60 million metric tons (more than a fourth of the harvest) to support prices, subsidizing marketing of corn, and rejecting imports.

Retired USDA economist Fred Gale peers through the "dim sums" of puzzling data that don't add up to provide insight about China's agricultural markets in bite-size pieces like Chinese "dim sum" snacks.

Veg Oil Prices Falling in China

Food Safety Insurance Offered

Haiyan County in Zhejiang Province is offering subsidized insurance against food safety incidents at rural banquets. The insurance covers victims of food safety incidents at group meals. It covers the personal injury, death, hospitalization, or burns of victims. It protects chefs against liability for negligence resulting in food poisoning, other food-borne illness, or foreign matter in food affecting five or more people.

The insurance premium is 10 yuan per table, with half paid by the district government.

According to the local food and drug monitoring bureau, there have been food safety incidents at rural banquets in recent years that threatened social stability. The local food safety monitoring officials say they came up with the pilot insurance system after conducting an assessment and gathered suggestions and arranging for an insurance company to participate. Food safety insurance pilots have already been underway in urban areas of the county for three months and are now being extended to villages.

Actually, the State Council ordered the establishment of a food safety responsibility insurance system in an October 2013 revised draft of the Food Safety Law issued by the . Quite a few provinces and localities are now offering the insurance.

Jiangsu Province was chosen to be a pilot province for offering food safety insurance five years ago. Jiangsu's Industrial and Commercial Bureau signed a contract with Jiangsu Chang'an Insurance Co. in 2008 to offer food safety insurance as a demonstration project. This insurance covers food production, distribution, and service establishments. Since September 2012, 3.3 million yuan in premiums have been collected, covering nearly 1000 companies. There have been claims for 14 incidents involving 610 people.

In November 2013, about a dozen people in Jiangsu's Taicang City were poisoned by spoiled food at a restaurant. The local government instructed the insurance company to launch emergency measures, sending people to visit the victims in the hospital and pay out 22,495 yuan in compensation.

The insurance premium is 10 yuan per table, with half paid by the district government.

According to the local food and drug monitoring bureau, there have been food safety incidents at rural banquets in recent years that threatened social stability. The local food safety monitoring officials say they came up with the pilot insurance system after conducting an assessment and gathered suggestions and arranging for an insurance company to participate. Food safety insurance pilots have already been underway in urban areas of the county for three months and are now being extended to villages.

Actually, the State Council ordered the establishment of a food safety responsibility insurance system in an October 2013 revised draft of the Food Safety Law issued by the . Quite a few provinces and localities are now offering the insurance.

Jiangsu Province was chosen to be a pilot province for offering food safety insurance five years ago. Jiangsu's Industrial and Commercial Bureau signed a contract with Jiangsu Chang'an Insurance Co. in 2008 to offer food safety insurance as a demonstration project. This insurance covers food production, distribution, and service establishments. Since September 2012, 3.3 million yuan in premiums have been collected, covering nearly 1000 companies. There have been claims for 14 incidents involving 610 people.

In November 2013, about a dozen people in Jiangsu's Taicang City were poisoned by spoiled food at a restaurant. The local government instructed the insurance company to launch emergency measures, sending people to visit the victims in the hospital and pay out 22,495 yuan in compensation.

Propping Up Poultry During H7N9

China's Zhejiang Province is giving emergency aid to key players in its poultry industry to tide them over through a severe downturn resulting from the H7N9 crisis.

Since December 2013, China's poultry sales volume and prices have fallen due to consumer fears that poultry could transmit H7N9 and many poultry markets have been closed. Poultry farms and processors have experienced serious losses and some face bankruptcy. On March 10, Zhejiang authorities issued a bulletin awarding emergency aid of 50 yuan per bird to core breeding farms that supply "grandparent" birds. The cost of the subsidy is split between provincial and local governments--70% provincial share in poor areas and 30% provincial share in other areas. The province is also giving subsidies of 80 yuan per metric ton to processors to keep their unsold inventories of chicken meat in cold storage during March through May.

The province's emergency bulletin called on local governments to give subsidized loans to processing plants and address their borrowing problems to tide the poultry companies over through the crisis. The bulletin also exhorted government organizations, schools, mining companies, supermarket chains and other units to take the lead in purchasing frozen poultry to revive sales.

On May 12, at the National Peoples Congress in Beijing the chairman of the New Hope Group, Liu Yonghao, requested government aid for the poultry industry. He said the industry had been blamed unfairly for the H7N9 epidemic, arguing that no poultry farms or companies have been implicated in transmitting the virus and have thus been victims of "discrimination from society." He claimed poultry farmers and companies had experienced losses of 80 billion yuan. Liu recommended removing the "avian" from references to "avian influenza" and educating the public on the cause of H7N9. Liu said the epidemic is like an earthquake or flood and the industry should receive similar emergency aid to compensate for their losses.

Since the beginning of the year, the price of broiler chicks has fallen from 3 yuan to 0.2 yuan and broiler chicken meat sales volume has fallen 30%.

An article about Suqian, a major chicken-producing area in northern Jiangsu, touts the market-stabilizing effect of marketing contracts. Farmers there have signed contracts to sell chickens to COFCO--China's state-owned agribusiness giant--and are able to keep selling to the company even though its sales have plummeted. In effect, COFCO is bearing the market risk.

Farmers in Suqian have been given guidance to implement biosecurity measures. Now all farms must strictly control people entering and exiting the farm and increase farm disinfections from twice a week to daily. Suqian officials strengthened oversight of poultry markets. Poultry entering the market have to go through strict inspection and quarantine and markets have to be disinfected regularly. No H7N9 has been detected in over 1100 samples tested.

Temporary subsidies to get farms and companies through a temporary downturn prevent instability that might result if poultry populations are decimated and processing capacity is lost through bankruptcy. Preserving the capacity through a temporary downturn averts future costs of having to rebuild when the market recovers. However, this is the second year in a row of a severe H7N9 crisis. Aid was given last year at this time, too.

Is there too much capacity in China's poultry industry? Where did all that poultry demand go? Chinese consumers haven't switched to pork--that industry is also experiencing plummeting prices (without major disease problems). Even the relentless rise of beef and mutton prices has cooled off in the last month.

Since December 2013, China's poultry sales volume and prices have fallen due to consumer fears that poultry could transmit H7N9 and many poultry markets have been closed. Poultry farms and processors have experienced serious losses and some face bankruptcy. On March 10, Zhejiang authorities issued a bulletin awarding emergency aid of 50 yuan per bird to core breeding farms that supply "grandparent" birds. The cost of the subsidy is split between provincial and local governments--70% provincial share in poor areas and 30% provincial share in other areas. The province is also giving subsidies of 80 yuan per metric ton to processors to keep their unsold inventories of chicken meat in cold storage during March through May.

Graphic showing emergency aid for poultry farms in Zhejiang Province.

The province's emergency bulletin called on local governments to give subsidized loans to processing plants and address their borrowing problems to tide the poultry companies over through the crisis. The bulletin also exhorted government organizations, schools, mining companies, supermarket chains and other units to take the lead in purchasing frozen poultry to revive sales.

On May 12, at the National Peoples Congress in Beijing the chairman of the New Hope Group, Liu Yonghao, requested government aid for the poultry industry. He said the industry had been blamed unfairly for the H7N9 epidemic, arguing that no poultry farms or companies have been implicated in transmitting the virus and have thus been victims of "discrimination from society." He claimed poultry farmers and companies had experienced losses of 80 billion yuan. Liu recommended removing the "avian" from references to "avian influenza" and educating the public on the cause of H7N9. Liu said the epidemic is like an earthquake or flood and the industry should receive similar emergency aid to compensate for their losses.

Since the beginning of the year, the price of broiler chicks has fallen from 3 yuan to 0.2 yuan and broiler chicken meat sales volume has fallen 30%.

An article about Suqian, a major chicken-producing area in northern Jiangsu, touts the market-stabilizing effect of marketing contracts. Farmers there have signed contracts to sell chickens to COFCO--China's state-owned agribusiness giant--and are able to keep selling to the company even though its sales have plummeted. In effect, COFCO is bearing the market risk.

Farmers in Suqian have been given guidance to implement biosecurity measures. Now all farms must strictly control people entering and exiting the farm and increase farm disinfections from twice a week to daily. Suqian officials strengthened oversight of poultry markets. Poultry entering the market have to go through strict inspection and quarantine and markets have to be disinfected regularly. No H7N9 has been detected in over 1100 samples tested.

Temporary subsidies to get farms and companies through a temporary downturn prevent instability that might result if poultry populations are decimated and processing capacity is lost through bankruptcy. Preserving the capacity through a temporary downturn averts future costs of having to rebuild when the market recovers. However, this is the second year in a row of a severe H7N9 crisis. Aid was given last year at this time, too.

Is there too much capacity in China's poultry industry? Where did all that poultry demand go? Chinese consumers haven't switched to pork--that industry is also experiencing plummeting prices (without major disease problems). Even the relentless rise of beef and mutton prices has cooled off in the last month.

Rumors on Target Price Subsidy Details

Chinese officials have announced plans to initiate "target price" subsidy trials for cotton and soybeans in 2014, but no details have been announced for these complicated programs.

A Grain and Oils Market News article reports that the details for the cotton subsidy trial have been settled but discussions of the soybean policy are progressing slowly and no details will be announced until late in the year.

Industry insiders say the "target price" subsidy for cotton will be 380 yuan per mu (about $380 per acre), and it will only be offered to farms in the Xinjiang Production Corps. The Production Corps is a network of farms and communities throughout the Xinjiang region which has a separate administration from that of the autonomous region. Rumors say farmers in Xinjiang outside the production corps will not be included in the subsidy trial, but the matter of which localities will get subsidies seems to be still under debate.

A task force has been set up to discuss details of the soybean target price subsidy trial. Rumors say the subsidy will be set at 200 yuan per mu (about $200 per acre). The task force is chaired by Nie Zhenbang, a former head of the grain bureau. Other members are communist party secretaries from several third-tier universities, director of a research institute affiliated with the grain bureau, the director of the National Grain and Oils Information Center (also part of the grain bureau system), executives from the Dalian and Zhengzhou commodity exchanges, and an agricultural policy advisor to the State Council who has been a vocal advocate of the target price subsidy.

Both rumored subsidy amounts are much higher than current subsidies for rice and wheat which are approximately 100 yuan per mu. Another article posted today recommends the cotton subsidy be set no lower than the amount of the grain subsidy.

According to rumors, the soybean subsidy task force's progress has been slow and difficult. They don't plan to issue recommendations to the government until July or later. An official with the Heilongjiang soybean industry association says he has heard no details about the forthcoming subsidy program.

An analysis in September 2013 pointed out there are many difficulties in implementing cotton target price subsidies. Planted area fluctuates depending on the price, so how is the acreage base for the subsidy set? There are no records or other information on cotton producers. While the United States implements cotton programs for 20,000 farms, China has 40 million cotton farms. The article implied the subsidy would need to be much higher than grain subsidies because production costs are higher. Setting a high subsidy prior to planting could lead to a surge of production that will depress the price at harvest time.

On March 5, Premier Li Keqiang said the minimum prices for wheat and rice will be raised and temporary reserve programs for corn, rapeseed, and sugar will be continued. He omitted soybeans and cotton, suggesting that temporary reserve programs will not continue this year. This raises concerns that farmers will lose their enthusiasm for planting soybeans and cotton.

In a press conference on March 6, Minister of Agriculture Han Changfu pointed out that subsidies only account for 3 percent of Chinese farmers' income, much lower than the 40-percent subsidies he claims are received by farmers in the United States and Europe. Han said China has plenty of room to increase subsidies.

There seems to be an urgency to eliminate the temporary reserve for cotton for the benefit of textile companies. The "Number One Finance News" said the direct subsidy is needed in "the most difficult year for textile enterprises" facing high raw material prices. For people who worry that farmers in Shandong and Henan Provinces will not get subsidies, one commentator urged that the entire industry chain should be considered, i.e. the benefits to textile producers of relieving them of having to pay artificially high raw material prices.

Grain and Oils Market News notes the irony that China is deciding the details of new target subsidies copied from the Americans at the same time the United States is eliminating direct subsidies in its new farm bill.

A Grain and Oils Market News article reports that the details for the cotton subsidy trial have been settled but discussions of the soybean policy are progressing slowly and no details will be announced until late in the year.

Industry insiders say the "target price" subsidy for cotton will be 380 yuan per mu (about $380 per acre), and it will only be offered to farms in the Xinjiang Production Corps. The Production Corps is a network of farms and communities throughout the Xinjiang region which has a separate administration from that of the autonomous region. Rumors say farmers in Xinjiang outside the production corps will not be included in the subsidy trial, but the matter of which localities will get subsidies seems to be still under debate.

A task force has been set up to discuss details of the soybean target price subsidy trial. Rumors say the subsidy will be set at 200 yuan per mu (about $200 per acre). The task force is chaired by Nie Zhenbang, a former head of the grain bureau. Other members are communist party secretaries from several third-tier universities, director of a research institute affiliated with the grain bureau, the director of the National Grain and Oils Information Center (also part of the grain bureau system), executives from the Dalian and Zhengzhou commodity exchanges, and an agricultural policy advisor to the State Council who has been a vocal advocate of the target price subsidy.

Both rumored subsidy amounts are much higher than current subsidies for rice and wheat which are approximately 100 yuan per mu. Another article posted today recommends the cotton subsidy be set no lower than the amount of the grain subsidy.

According to rumors, the soybean subsidy task force's progress has been slow and difficult. They don't plan to issue recommendations to the government until July or later. An official with the Heilongjiang soybean industry association says he has heard no details about the forthcoming subsidy program.

An analysis in September 2013 pointed out there are many difficulties in implementing cotton target price subsidies. Planted area fluctuates depending on the price, so how is the acreage base for the subsidy set? There are no records or other information on cotton producers. While the United States implements cotton programs for 20,000 farms, China has 40 million cotton farms. The article implied the subsidy would need to be much higher than grain subsidies because production costs are higher. Setting a high subsidy prior to planting could lead to a surge of production that will depress the price at harvest time.

On March 5, Premier Li Keqiang said the minimum prices for wheat and rice will be raised and temporary reserve programs for corn, rapeseed, and sugar will be continued. He omitted soybeans and cotton, suggesting that temporary reserve programs will not continue this year. This raises concerns that farmers will lose their enthusiasm for planting soybeans and cotton.

In a press conference on March 6, Minister of Agriculture Han Changfu pointed out that subsidies only account for 3 percent of Chinese farmers' income, much lower than the 40-percent subsidies he claims are received by farmers in the United States and Europe. Han said China has plenty of room to increase subsidies.

There seems to be an urgency to eliminate the temporary reserve for cotton for the benefit of textile companies. The "Number One Finance News" said the direct subsidy is needed in "the most difficult year for textile enterprises" facing high raw material prices. For people who worry that farmers in Shandong and Henan Provinces will not get subsidies, one commentator urged that the entire industry chain should be considered, i.e. the benefits to textile producers of relieving them of having to pay artificially high raw material prices.

Grain and Oils Market News notes the irony that China is deciding the details of new target subsidies copied from the Americans at the same time the United States is eliminating direct subsidies in its new farm bill.

Athletes Can't Eat Chinese Meat

The use of banned substances in feeding livestock is so pervasive in China that athletes at the country's elite sports training centers are forbidden from eating meat.

The most common problem is use of beta agonists, commonly known in China as "lean meat powder." These substances promote formation of muscle instead of fat as the animal gains weight. Clenbuterol is the most common beta agonist, but ractopamine, salbutamol and others are also used to produce muscular "bodybuilder pigs." Beta agonists have been banned in China since 2000 and there was a prominent scandal in 2011 when their extensive use was revealed by a television report. Hormones and other substances are also a concern.

During the 2008 Beijing Olympics athletes were not permitted to eat outside the Olympic village because of this concern. About 10 closely guarded secret farms were operated to provide pork for the athletes.

In 2010, a member of China's judo team was banned for two years for failing drug tests. The team blamed it on "lean meat powder" consumed in pork. The judo team started its own pig farm to supply the athletes.

In December 2013, a widely-posted article reported that many of China's elite training centers have forbidden their athletes to eat pork and other meat because they might fail doping tests at international competitions. There are also concerns that routine ingestion of clenbuterol could also cause cardiac damage to athletes.

The director of the aquatic sports training center told media the athletes had stopped eating meat for 40 days, and "all the dumplings eaten during the spring festival were vegetarian."

A female rowing champion in Guangzhou revealed on a microblog, “Today the [sports] bureau notified us athletes are forbidden to eat pork. Even mutton and beef may not be eaten outside [the training center]. Only chicken and fish are allowed.”

A coach of the women's ping pong team once told the reporter, “Athletes can’t eat meat common people can eat; we eat meat tested in Beijing and shipped specially to Chengdu.”

The national badminton team coach said the team members may only eat meat specially supplied to the team. They may not eat meat "in society."

Athletic officials are also concerned because a "biological passport" is being adopted as an anti-doping measure. This entails monitoring athletes' bodies for evidence of banned substances in place of testing.

National Sports Bureau officials made several visits to meat suppliers, but they have not been encouraged. They think very few meat suppliers can reach their standards. The officials are anxious about this problem.

So-called "lean meat powder" has been a point of conflict between China and the United States. Like China, the U.S. bans clenbuterol, but the U.S. allows ractopamine another beta agonist developed as a safe alternative to clenbuterol. Ractopamine was designed to flush out of the animal's body to prevent harmful residues at slaughter. China bans all beta agonists, ignoring test results showing that concentrations of ractopamine at slaughter are within China's tolerances.

In June 2013, China's Minister of Commerce addressed accusations that China's market was closed to American pork by pointing out that China's market is only closed to "lean meat powder." He said pork from other countries must meet China's quality and safety standards and regulations.

Athletes in the United States can eat anywhere and don't have to worry about eating meat that will cause them to fail doping tests or have heart attacks. Yet the meat American athletes eat is banned in China while clenbuterol is apparently so prevalent in China's meat that Chinese athletes cannot eat anywhere in their country without being at risk of ingesting banned substances in their meat.

At the time of the Olympics, some Chinese citizens asked why the common people couldn't eat safe pork like athletes. Chinese common people are consigned to consuming tainted local food with real risks while safe food from other countries is banned from their market over an infinitesimal risk.

The most common problem is use of beta agonists, commonly known in China as "lean meat powder." These substances promote formation of muscle instead of fat as the animal gains weight. Clenbuterol is the most common beta agonist, but ractopamine, salbutamol and others are also used to produce muscular "bodybuilder pigs." Beta agonists have been banned in China since 2000 and there was a prominent scandal in 2011 when their extensive use was revealed by a television report. Hormones and other substances are also a concern.

During the 2008 Beijing Olympics athletes were not permitted to eat outside the Olympic village because of this concern. About 10 closely guarded secret farms were operated to provide pork for the athletes.

In 2010, a member of China's judo team was banned for two years for failing drug tests. The team blamed it on "lean meat powder" consumed in pork. The judo team started its own pig farm to supply the athletes.

In December 2013, a widely-posted article reported that many of China's elite training centers have forbidden their athletes to eat pork and other meat because they might fail doping tests at international competitions. There are also concerns that routine ingestion of clenbuterol could also cause cardiac damage to athletes.

The director of the aquatic sports training center told media the athletes had stopped eating meat for 40 days, and "all the dumplings eaten during the spring festival were vegetarian."

A female rowing champion in Guangzhou revealed on a microblog, “Today the [sports] bureau notified us athletes are forbidden to eat pork. Even mutton and beef may not be eaten outside [the training center]. Only chicken and fish are allowed.”

A coach of the women's ping pong team once told the reporter, “Athletes can’t eat meat common people can eat; we eat meat tested in Beijing and shipped specially to Chengdu.”

The national badminton team coach said the team members may only eat meat specially supplied to the team. They may not eat meat "in society."

Athletic officials are also concerned because a "biological passport" is being adopted as an anti-doping measure. This entails monitoring athletes' bodies for evidence of banned substances in place of testing.

National Sports Bureau officials made several visits to meat suppliers, but they have not been encouraged. They think very few meat suppliers can reach their standards. The officials are anxious about this problem.

So-called "lean meat powder" has been a point of conflict between China and the United States. Like China, the U.S. bans clenbuterol, but the U.S. allows ractopamine another beta agonist developed as a safe alternative to clenbuterol. Ractopamine was designed to flush out of the animal's body to prevent harmful residues at slaughter. China bans all beta agonists, ignoring test results showing that concentrations of ractopamine at slaughter are within China's tolerances.

In June 2013, China's Minister of Commerce addressed accusations that China's market was closed to American pork by pointing out that China's market is only closed to "lean meat powder." He said pork from other countries must meet China's quality and safety standards and regulations.

Athletes in the United States can eat anywhere and don't have to worry about eating meat that will cause them to fail doping tests or have heart attacks. Yet the meat American athletes eat is banned in China while clenbuterol is apparently so prevalent in China's meat that Chinese athletes cannot eat anywhere in their country without being at risk of ingesting banned substances in their meat.

At the time of the Olympics, some Chinese citizens asked why the common people couldn't eat safe pork like athletes. Chinese common people are consigned to consuming tainted local food with real risks while safe food from other countries is banned from their market over an infinitesimal risk.

China's Feed Industry Adapts Under Pressure

Until last year, it appeared that China would increase meat consumption relentlessly, with knock-on impacts on the feed industry that would slurp up the world's grain supply. An analysis of China's feed industry for 2013 shows both feed manufacturers and livestock producers have made adaptations to cut costs during a sharp slowdown. Feed companies are consolidating and the strong ones are using the crisis to launch new business strategies.

According to feed industry association statistics based on regular reporting by companies, China produced 191 million metric tons of manufactured animal feed during 2013. China's feed industry surpassed the United States a couple years ago to become the largest in the world. But after growing at rates of 7-to-12 percent during 2010-12, China's feed industry output fell 1.8 percent during 2013.

The industry was affected by a number of factors that hit China's meat industry during 2013. Demand for meat was slowed by the general slowing of the economy. Moreover, communist party authorities issued "eight regulations" which ordered officials to dial back their banqueting, putting a crimp on meat demand since banquets always include numerous meat dishes. Without the artificially inflated demand created by banqueting in past years, there seems to be slack in demand.

Poultry was hit by two incidents. In late 2012, an expose on China's Central Television revealed that chicken suppliers routinely flouted regulations on feeding pharmaceuticals to their chickens. In March 2013, the H7N9 avian influenza epidemic shut down many poultry markets and reduced poultry consumption. Poultry processors were seriously affected and had to put large amounts of meat in storage. Farmers and breeders reduced their chicken flocks.

The pork industry had excess capacity and downward pressure on prices early in 2013. Publicity from pig carcasses found floating in Shanghai's Huangpu River further depressed pork consumption.

The composition of feed products changed, reflecting the flexibility of livestock producers adjusting to the depressed market. During the down period, livestock producers have reverted to mixing their own feed on-farm with cheaper local materials instead of buying ready-made compound feeds. The hottest feed products were premixes and additives which grew 1.7%. Production of compound feeds declined 1.2 percent, a reversal of rapid growth in this type of feed in the last few years. The increase in pre-mixes reflects the surge in on-farm feed-mixing. These products--which contain vitamins, amino acids, trace elements and other nutrients--are mixed on-farm with other feed stuffs. Similarly, large-scale commercial farms also shifted toward more on-farm mixing of feed instead of purchasing ready-made formulated feed. Compound feed is still the predominant product, with output at 161.7 mmt, compared with 6.3 mmt of premixes and additives.

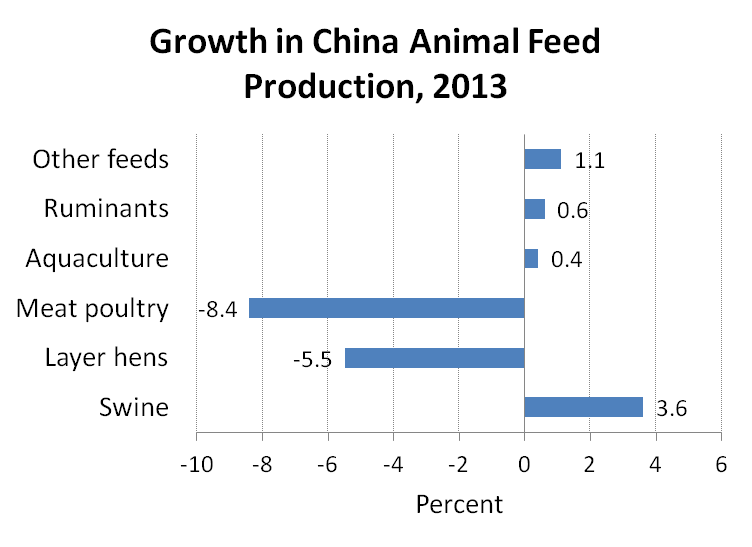

Poultry feed took the biggest hit during 2013. Feed for meat poultry was down 8.4 percent and feed for layer hens was down 5.5 percent. Poultry has a disproportionate impact on the feed industry. These two types of poultry accounted for over 40 percent of China's feed output in 2013, about equal to the share of feed produced for swine. In comparison, pork accounts for about two-thirds of China's meat output. Pig feed production went up 3.6 percent in 2013, but that was slower than in previous years.

Similarly, provinces that produce a lot of poultry feed were the hardest hit. During the first three quarters of 2013, Shandong's feed output fell 15.1%, neighboring Hebei's production was down 6.1%, Guangdong's fell 3.2% and Henan's fell 4.1%. Feed production was stable or grew in central and western provinces. Growth in feed output was 4.3% in southwest provinces and 3% in central and northeastern provinces.

Chinese feed companies are facing broad cost pressures from rising labor costs, energy, and expenses like marketing fees, financing costs, and management costs. Corn costs had been rising from 2010 to 2012, but prices fell slightly during 2013. China's corn prices are still at a high level, however. Companies face environmental constraints and difficulty gaining access to land. With the adoption of international standards, business costs are rising.

The article describes Chinese feed companies as taking the opportunity of the crisis to make strategic adjustments in what is described as a key period in the industry's transformation. Some are using the down period to retool and acquire new equipment. Large companies are getting bigger and some small companies are merging together. Weak companies are vulnerable to bankruptcy or takeover. Some feed companies are forward-integrating into livestock production. Many of the larger companies "no longer think of themselves as feed companies." With costs rising and margins slim, feed companies are diversifying to find profits.

For example, in September 2013 a feed company called Dabeinong announced a 7-year plan to jointly operate a network of giant farms supplying hybrid sows to farmers. They are concentrating on sows because they bring a profit of several thousand yuan while the hog-fattening business earns only 200-yuan per head. They plan to invest 1 billion yuan with a goal of producing 6 million hogs annually with slaughter capacity of 4 million head. The investments of the company, Heilongjiang's provincial government and farmers are expected to total 10 billion yuan.

A commentary on the future of the feed industry urged companies to rethink how they do business by automating operations, focusing on e-commerce, and offering financial, data, information, and Internet services.

The upgrading and consolidation is driven by competitive pressures and encouragement from the government. A series of food safety incidents have undermined consumer confidence in meat products. Addressing animal disease concerns are another priority. The government is pushing integration, concentration, and larger scale in the feed and livestock industries. In October last year, a plan for beef and mutton industry development called on each locality to develop a big flagship company. Draft State Council regulations for controlling livestock pollution emissions also call for increasing the scale and standardization of livestock farms. Also, last year companies had to renew their production licenses, requiring upgrades to stay in business.

2014 was supposed to be a year of recovery for the feed industry, but it got off to a bad start. Hog farms are losing money, another outbreak of avian influenza is keeping the poultry industry depressed, and the government is supporting corn prices at an artificially high level.

According to feed industry association statistics based on regular reporting by companies, China produced 191 million metric tons of manufactured animal feed during 2013. China's feed industry surpassed the United States a couple years ago to become the largest in the world. But after growing at rates of 7-to-12 percent during 2010-12, China's feed industry output fell 1.8 percent during 2013.

The industry was affected by a number of factors that hit China's meat industry during 2013. Demand for meat was slowed by the general slowing of the economy. Moreover, communist party authorities issued "eight regulations" which ordered officials to dial back their banqueting, putting a crimp on meat demand since banquets always include numerous meat dishes. Without the artificially inflated demand created by banqueting in past years, there seems to be slack in demand.

Poultry was hit by two incidents. In late 2012, an expose on China's Central Television revealed that chicken suppliers routinely flouted regulations on feeding pharmaceuticals to their chickens. In March 2013, the H7N9 avian influenza epidemic shut down many poultry markets and reduced poultry consumption. Poultry processors were seriously affected and had to put large amounts of meat in storage. Farmers and breeders reduced their chicken flocks.

The pork industry had excess capacity and downward pressure on prices early in 2013. Publicity from pig carcasses found floating in Shanghai's Huangpu River further depressed pork consumption.

Packets of amino acids to be mixed with feeds by farmers at a shop in Chongqing.

The composition of feed products changed, reflecting the flexibility of livestock producers adjusting to the depressed market. During the down period, livestock producers have reverted to mixing their own feed on-farm with cheaper local materials instead of buying ready-made compound feeds. The hottest feed products were premixes and additives which grew 1.7%. Production of compound feeds declined 1.2 percent, a reversal of rapid growth in this type of feed in the last few years. The increase in pre-mixes reflects the surge in on-farm feed-mixing. These products--which contain vitamins, amino acids, trace elements and other nutrients--are mixed on-farm with other feed stuffs. Similarly, large-scale commercial farms also shifted toward more on-farm mixing of feed instead of purchasing ready-made formulated feed. Compound feed is still the predominant product, with output at 161.7 mmt, compared with 6.3 mmt of premixes and additives.

Poultry feed took the biggest hit during 2013. Feed for meat poultry was down 8.4 percent and feed for layer hens was down 5.5 percent. Poultry has a disproportionate impact on the feed industry. These two types of poultry accounted for over 40 percent of China's feed output in 2013, about equal to the share of feed produced for swine. In comparison, pork accounts for about two-thirds of China's meat output. Pig feed production went up 3.6 percent in 2013, but that was slower than in previous years.

Source: Dimsums, using data from China Feed Industry Association.

Similarly, provinces that produce a lot of poultry feed were the hardest hit. During the first three quarters of 2013, Shandong's feed output fell 15.1%, neighboring Hebei's production was down 6.1%, Guangdong's fell 3.2% and Henan's fell 4.1%. Feed production was stable or grew in central and western provinces. Growth in feed output was 4.3% in southwest provinces and 3% in central and northeastern provinces.

Chinese feed companies are facing broad cost pressures from rising labor costs, energy, and expenses like marketing fees, financing costs, and management costs. Corn costs had been rising from 2010 to 2012, but prices fell slightly during 2013. China's corn prices are still at a high level, however. Companies face environmental constraints and difficulty gaining access to land. With the adoption of international standards, business costs are rising.

The article describes Chinese feed companies as taking the opportunity of the crisis to make strategic adjustments in what is described as a key period in the industry's transformation. Some are using the down period to retool and acquire new equipment. Large companies are getting bigger and some small companies are merging together. Weak companies are vulnerable to bankruptcy or takeover. Some feed companies are forward-integrating into livestock production. Many of the larger companies "no longer think of themselves as feed companies." With costs rising and margins slim, feed companies are diversifying to find profits.

For example, in September 2013 a feed company called Dabeinong announced a 7-year plan to jointly operate a network of giant farms supplying hybrid sows to farmers. They are concentrating on sows because they bring a profit of several thousand yuan while the hog-fattening business earns only 200-yuan per head. They plan to invest 1 billion yuan with a goal of producing 6 million hogs annually with slaughter capacity of 4 million head. The investments of the company, Heilongjiang's provincial government and farmers are expected to total 10 billion yuan.

A commentary on the future of the feed industry urged companies to rethink how they do business by automating operations, focusing on e-commerce, and offering financial, data, information, and Internet services.

The upgrading and consolidation is driven by competitive pressures and encouragement from the government. A series of food safety incidents have undermined consumer confidence in meat products. Addressing animal disease concerns are another priority. The government is pushing integration, concentration, and larger scale in the feed and livestock industries. In October last year, a plan for beef and mutton industry development called on each locality to develop a big flagship company. Draft State Council regulations for controlling livestock pollution emissions also call for increasing the scale and standardization of livestock farms. Also, last year companies had to renew their production licenses, requiring upgrades to stay in business.

2014 was supposed to be a year of recovery for the feed industry, but it got off to a bad start. Hog farms are losing money, another outbreak of avian influenza is keeping the poultry industry depressed, and the government is supporting corn prices at an artificially high level.

Subscribe to:

Comments (Atom)

China Promotes International Food Safety Scheme for BRI Countries

A country with a bad food safety record aspires to lead a new approach to setting food safety practices in international trade. This is part...